Aspen Group, Inc. Reports 1,746 Third Quarter Enrollments, a 28% Increase Year-Over-Year; Quarterly Bookings Rose to $26.5 Million, a 72% Increase Year-Over-Year

Reaffirms Fiscal 2020 Bookings Guidance of at least $102 Million

|

|||||

Management to Announce Fiscal Year 2020 Third Quarter Results on March 10, 2020

NEW YORK, Feb. 19, 2020 (GLOBE NEWSWIRE) -- Aspen Group, Inc. (“AGI”) (Nasdaq: ASPU), an education technology holding company, today announced third quarter new student enrollments of 1,746 in fiscal 2020 third quarter ending January 31, 2020, an increase of 28% year-over-year. Quarterly bookings increased 72% year-over-year from $15.5 million to $26.5 million. Consequently, total bookings for the first nine months of fiscal 2020 was $84.7 million, which on a run rate basis is on track to meet or exceed the company’s forecast for fiscal 2020 bookings growth of 54% to $102 million.

“Our marketing strategy delivered another quarter of very strong bookings growth, driven by enrollment in our highest LTV programs. Our Pre-Licensure BSN growth plan is on track with two new campuses, Austin, TX and Tampa, FL, set to open in calendar year 2020. We are leveraging our campus investments to include both the PL-BSN program, as well as MSN-FNP weekend clinical immersions. We expect our PL-BSN and MSN-FNP programs will be key drivers of our top line growth and profitability over the next five years, driven by our attractive tuition rates, the need for more nursing schools nationwide and our targeted expansion to 12 operational campuses by 2024,” said Chairman & CEO, Michael Mathews. “Since joining Aspen Group in early December as CFO, Frank Cotroneo has implemented new protocols to streamline Aspen’s reporting and align our disclosure methodology with standard industry practices. Accordingly, we will present new student enrollment results, weighted average cost per enrollment (CAC), weighted average lifetime value (LTV), marketing efficiency ratio (MER), bookings and the total active student body on a quarterly basis for each of Aspen Group’s universities. Our team remains laser focused on executing to our strategy to grow revenue, improve profitability, and increase shareholder value.”

For the third quarter of fiscal year 2020, Aspen University accounted for 1,371 new student enrollments delivering overall enrollment growth at Aspen University of 23% year-over-year. Enrollment growth at Aspen University was driven primarily by the Pre-Licensure BSN program as a result of a full quarter of enrollments at both Phoenix, AZ campuses, as compared to the prior year with only one campus open.

United States University (“USU”) accounted for 375 new student enrollments in the quarter driven primarily by MSN-Family Nurse Practitioner (“FNP”) enrollments, a 49% enrollment increase year-over-year.

Below is a table reflecting new student enrollments for the past five quarters:

| New Student Enrollments | |||||

| Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | |

| Aspen University | 1,112 | 1,243 | 1,415 | 1,823 | 1,371 |

| USU | 251 | 317 | 514 | 394 | 375 |

| Total | 1,363 | 1,560 | 1,929 | 2,217 | 1,746 |

The current third quarter fiscal year 2020 Marketing Efficiency Ratio (MER), representing revenue-per-enrollment (LTV) over cost-per-enrollment (CAC), for our universities is reflected in the below table:

| Marketing Efficiency Ratio | |||||

| Enrollments | CAC1 | LTV2 | MER | ||

| Aspen University | 1,371 | 961 | $ | 14,4823 | 15.1X |

| USU | 375 | 1,103 | $ | 17,8204 | 16.2X |

1Based on 6-month rolling weighted average CAC for each university’s enrollments

2Lifetime Value (LTV) of a new student enrollment

3Weighted average LTV for all Aspen University enrollments in the quarter

4LTV for USU’s MSN-FNP Program

The improved year-over-year MER results were driven by declining cost of enrollment. Compared to the previous year, AGI’s weighted average cost of enrollment declined 28%, from $1,373 to $989.

| Weighted Average Cost of Enrollment | ||||||||

| Q3 ‘19 Enrollments |

Q3 ’19 CAC1 | Q3 ‘20 Enrollments |

Q3 ’20 CAC1 | Percent Change CAC | ||||

| Aspen University | 1,112 | $ | 1,320 | 1,371 | $ | 961 | -27 | % |

| USU | 251 | $ | 1,620 | 375 | $ | 1,103 | -32 | % |

| Weighted Average | $ | 1,373 | $ | 989 | -28 | % | ||

1Based on 6-month rolling average

On a year-over-year basis, fiscal Q3’20 bookings increased 72%, from $15.5 million to $26.5 million, delivering a company-wide average revenue per enrollment (ARPU) increase of 34%, from $11,352 to $15,199.

| Total Bookings and Average Revenue Per Enrollment (ARPU) | ||||||||

| Q3'2019 Enrollments | Q3'2019 Bookings1 | Q3'2020 Enrollments | Q3'2020 Bookings1 | Percent Change Total Bookings & ARPU |

||||

| Aspen University | 1,112 | $ | 11,000,250 | 1,371 | $ | 19,855,050 | ||

| USU | 251 | $ | 4,472,820 | 375 | $ | 6,682,500 | ||

| Total | 1,363 | $ | 15,473,070 | 1,746 | $ | 26,537,550 | 72 | % |

| ARPU | $ | 11,352 | $ | 15,199 | 34 | % | ||

1“Bookings” are defined by multiplying Lifetime Value (LTV) per enrollment by new student enrollments for each operating unit.

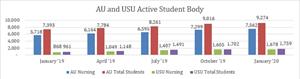

AGI’s overall active student body (includes both Aspen University and USU) grew 32% year-over-year from 8,354 to 11,033. Aspen University’s total active degree-seeking student body grew 25% year-over-year from 7,393 to 9,274.

Aspen University students paying tuition and fees through a monthly payment method grew by 13% year-over-year, from 5,259 to 5,966, representing 64% of Aspen University’s total active student body.

On a year-over-year basis, USU’s total active student body grew from 961 to 1,759 or 83%. USU students paying tuition and fees through a monthly payment method grew from 1,101 to 1,159 students sequentially representing 66% of USU’s total active student body.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4365f70d-924e-44df-acee-b57bd0215216

Fiscal 2020 Q3 Earnings Conference Call Details:

Aspen Group, Inc. will host a conference call to discuss its fiscal year 2020 2nd quarter financial results and business outlook on Tuesday, March 10th, 2020, at 4:30 p.m. (ET). Aspen will issue a press release reporting results after the market closes on that day. The conference call can be accessed by dialing toll-free (844) 452-6823 (U.S.) or (731) 256-5216 (international), passcode 7808728. Subsequent to the call, a transcript of the audiocast will be available from the Company’s website at ir.aspen.edu. There will also be a 7 day dial-in replay which can be accessed by dialing toll-free (855) 859-2056 or (404) 537-3406 (international), passcode 7808728.

About Aspen Group, Inc.:

Aspen Group, Inc. is an education technology holding company that leverages its infrastructure and expertise to allow its two universities, Aspen University and United States University, to deliver on the vision of making college affordable again. For more information, visit www.aspu.com.

Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including five year top line growth and profitability, campus expansion and the future impact of bookings. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include the continued demand of nursing students for the new programs, student attrition and national and local economic factors. Other risks are included in our filings with the SEC including our Form 10-K for the year ended April 30, 2019, Form 10-Q for the three months ended July 31, 2019 and prospectus supplement dated January 17, 2020. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Investor Relations Contact:

Kimberly Rogers

Hayden IR

(385) 831-7337

Kim@HaydenIR.com

ircontact@aspen.edu

Released February 19, 2020