false--04-30Q2202000014871980.08333P6M.333300014871982019-05-012019-10-31xbrli:shares00014871982019-12-06iso4217:USD00014871982019-10-3100014871982019-04-300001487198aspu:IntangibleAssetsOtherThanCoursewareAndAccreditationMember2019-10-310001487198aspu:IntangibleAssetsOtherThanCoursewareAndAccreditationMember2019-04-300001487198aspu:CoursewareAndAccreditationMember2019-10-310001487198aspu:CoursewareAndAccreditationMember2019-04-30iso4217:USDxbrli:shares00014871982019-08-012019-10-3100014871982018-08-012018-10-3100014871982018-05-012018-10-310001487198us-gaap:CommonStockMember2019-07-310001487198us-gaap:AdditionalPaidInCapitalMember2019-07-310001487198us-gaap:TreasuryStockMember2019-07-310001487198us-gaap:RetainedEarningsMember2019-07-3100014871982019-07-310001487198us-gaap:AdditionalPaidInCapitalMember2019-08-012019-10-310001487198us-gaap:CommonStockMember2019-08-012019-10-310001487198us-gaap:RetainedEarningsMember2019-08-012019-10-310001487198us-gaap:CommonStockMember2019-10-310001487198us-gaap:AdditionalPaidInCapitalMember2019-10-310001487198us-gaap:TreasuryStockMember2019-10-310001487198us-gaap:RetainedEarningsMember2019-10-310001487198us-gaap:CommonStockMember2018-07-310001487198us-gaap:AdditionalPaidInCapitalMember2018-07-310001487198us-gaap:TreasuryStockMember2018-07-310001487198us-gaap:RetainedEarningsMember2018-07-3100014871982018-07-310001487198us-gaap:AdditionalPaidInCapitalMember2018-08-012018-10-310001487198us-gaap:CommonStockMember2018-08-012018-10-310001487198us-gaap:RetainedEarningsMember2018-08-012018-10-310001487198us-gaap:CommonStockMember2018-10-310001487198us-gaap:AdditionalPaidInCapitalMember2018-10-310001487198us-gaap:TreasuryStockMember2018-10-310001487198us-gaap:RetainedEarningsMember2018-10-3100014871982018-10-310001487198us-gaap:CommonStockMember2019-04-300001487198us-gaap:AdditionalPaidInCapitalMember2019-04-300001487198us-gaap:TreasuryStockMember2019-04-300001487198us-gaap:RetainedEarningsMember2019-04-300001487198us-gaap:AdditionalPaidInCapitalMember2019-05-012019-10-310001487198us-gaap:CommonStockMember2019-05-012019-10-310001487198us-gaap:RetainedEarningsMember2019-05-012019-10-310001487198us-gaap:CommonStockMember2018-04-300001487198us-gaap:AdditionalPaidInCapitalMember2018-04-300001487198us-gaap:TreasuryStockMember2018-04-300001487198us-gaap:RetainedEarningsMember2018-04-3000014871982018-04-300001487198us-gaap:AdditionalPaidInCapitalMember2018-05-012018-10-310001487198us-gaap:CommonStockMember2018-05-012018-10-310001487198us-gaap:TreasuryStockMember2018-05-012018-10-310001487198us-gaap:RetainedEarningsMember2018-05-012018-10-31aspu:subsidiaryxbrli:pure0001487198us-gaap:RevolvingCreditFacilityMember2018-11-05aspu:agreement00014871982019-03-012019-03-310001487198aspu:LoanAgreementTwoMember2019-03-060001487198aspu:LoanAgreementOneMember2019-03-060001487198aspu:LeonAndTobyCoopermanFamilyFoundationMemberaspu:LoanAgreementsMember2019-03-012019-03-310001487198us-gaap:LetterOfCreditMember2019-10-310001487198aspu:CallCenterMember2019-05-012019-10-310001487198aspu:ComputerAndOfficeEquipmentMember2019-05-012019-10-310001487198us-gaap:FurnitureAndFixturesMember2019-05-012019-10-310001487198aspu:LibraryMember2019-05-012019-10-310001487198us-gaap:ComputerSoftwareIntangibleAssetMember2019-05-012019-10-3100014871982019-05-010001487198us-gaap:WarrantMember2019-05-012019-10-310001487198us-gaap:WarrantMember2018-05-012018-10-310001487198aspu:UnvestedRestrictedStockMember2019-05-012019-10-310001487198aspu:UnvestedRestrictedStockMember2018-05-012018-10-310001487198us-gaap:ConvertibleDebtMember2019-10-310001487198us-gaap:ConvertibleDebtMember2018-10-310001487198us-gaap:ConvertibleDebtMember2019-05-012019-10-310001487198us-gaap:ConvertibleDebtMember2018-05-012018-10-31aspu:segment0001487198aspu:CallCenterMember2019-10-310001487198aspu:CallCenterMember2019-04-300001487198aspu:ComputerAndOfficeEquipmentMember2019-10-310001487198aspu:ComputerAndOfficeEquipmentMember2019-04-300001487198us-gaap:FurnitureAndFixturesMember2019-10-310001487198us-gaap:FurnitureAndFixturesMember2019-04-300001487198us-gaap:ComputerSoftwareIntangibleAssetMember2019-10-310001487198us-gaap:ComputerSoftwareIntangibleAssetMember2019-04-300001487198aspu:EducacionSignificativaLLCMember2019-05-012019-10-310001487198aspu:EducacionSignificativaLLCMember2018-05-012019-04-300001487198aspu:EducacionSignificativaLLCMember2019-10-310001487198aspu:EducacionSignificativaLLCMember2019-04-300001487198aspu:CoursewareMember2019-05-012019-10-310001487198aspu:CoursewareMember2018-05-012019-04-300001487198aspu:CoursewareMember2019-10-310001487198aspu:CoursewareMember2019-04-300001487198aspu:AccreditationMember2019-10-310001487198aspu:AccreditationMember2019-04-300001487198aspu:AccreditationMember2019-05-012019-10-310001487198aspu:AccreditationMember2018-05-012019-04-300001487198aspu:CoursewareMember2019-08-012019-10-310001487198aspu:CoursewareMember2018-08-012018-10-310001487198aspu:CoursewareMember2018-05-012018-10-310001487198aspu:ConvertiblePromissoryNoteDatedFebruaryTwentyNineTwoThousandTwelveMember2012-02-290001487198aspu:TwoYearPromissoryNotesMember2012-02-290001487198aspu:HemgMember2019-02-280001487198us-gaap:RevolvingCreditFacilityMemberaspu:CreditFacilityAgreementMember2018-11-050001487198us-gaap:RevolvingCreditFacilityMemberaspu:CreditFacilityAgreementMember2018-11-012018-11-050001487198aspu:LeonAndTobyCoopermanFamilyFoundationMemberaspu:LoanAgreementsMember2019-03-012019-03-060001487198aspu:LeonAndTobyCoopermanFamilyFoundationMemberaspu:LoanAgreementsMember2019-03-060001487198aspu:LoanAgreementsMember2019-03-012019-03-060001487198aspu:WarrantsMemberaspu:LoanAgreementsMember2019-03-012019-03-0600014871982012-02-292012-02-290001487198srt:MaximumMemberus-gaap:CommonStockMember2019-06-280001487198us-gaap:CommonStockMembersrt:MinimumMember2019-06-280001487198srt:MaximumMemberus-gaap:PreferredStockMember2019-06-280001487198us-gaap:PreferredStockMembersrt:MinimumMember2019-06-280001487198us-gaap:CommonStockMember2019-05-012019-07-3100014871982019-05-012019-07-310001487198aspu:WarrantsMember2019-10-310001487198srt:DirectorMember2019-05-012019-07-310001487198us-gaap:RestrictedStockMemberaspu:AndrewKaplanMember2019-06-182019-06-180001487198us-gaap:RestrictedStockMemberaspu:TwoFormerDirectorsMember2019-06-182019-06-180001487198us-gaap:InvestorMember2019-05-012019-10-310001487198us-gaap:RestrictedStockMemberus-gaap:InvestorMember2019-10-310001487198us-gaap:RestrictedStockMembersrt:ChiefFinancialOfficerMember2018-09-012018-09-300001487198us-gaap:RestrictedStockMembersrt:ChiefFinancialOfficerMember2018-09-300001487198us-gaap:RestrictedStockMember2018-12-240001487198us-gaap:RestrictedStockMembersrt:DirectorMember2018-12-012018-12-240001487198us-gaap:RestrictedStockMember2018-12-242018-12-240001487198us-gaap:WarrantMember2019-04-300001487198us-gaap:WarrantMember2019-04-302019-04-300001487198us-gaap:WarrantMember2019-05-012019-10-310001487198us-gaap:WarrantMember2019-10-310001487198us-gaap:WarrantMember2019-10-312019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeNineMemberus-gaap:WarrantMember2019-05-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeNineMemberus-gaap:WarrantMember2019-10-310001487198us-gaap:WarrantMemberaspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFiveEightFiveMember2019-05-012019-10-310001487198us-gaap:WarrantMemberaspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFiveEightFiveMember2019-10-310001487198us-gaap:WarrantMemberaspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSixZeroMember2019-05-012019-10-310001487198us-gaap:WarrantMemberaspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSixZeroMember2019-10-310001487198us-gaap:WarrantMemberaspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeElevenMember2019-05-012019-10-310001487198us-gaap:WarrantMemberaspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeElevenMember2019-10-310001487198us-gaap:InvestorMemberaspu:WarrantsMember2019-08-172019-08-170001487198us-gaap:InvestorMember2019-08-172019-08-17aspu:investor00014871982019-08-200001487198aspu:Investor1Memberaspu:WarrantsMember2019-08-202019-08-200001487198aspu:Investor2Memberaspu:WarrantsMember2019-08-202019-08-200001487198aspu:Investor1Member2019-08-202019-08-200001487198aspu:Investor2Member2019-08-202019-08-200001487198aspu:WarrantsMemberaspu:FormerDirectorMember2019-06-030001487198aspu:FormerDirectorMember2019-06-030001487198srt:ChiefExecutiveOfficerMember2019-06-070001487198aspu:EquityIncentivePlanMember2012-03-130001487198aspu:EquityIncentivePlanMember2019-10-310001487198aspu:EquityIncentivePlanMember2018-12-130001487198us-gaap:SubsequentEventMemberaspu:EquityIncentivePlanMember2019-12-300001487198us-gaap:ScenarioPlanMemberus-gaap:SubsequentEventMemberaspu:EquityIncentivePlanMember2019-12-300001487198aspu:StockOptionGrantsToEmployeesAndDirectorsMember2019-05-012019-10-3100014871982018-05-012019-04-300001487198aspu:StockOptionGrantsToEmployeesAndDirectorsMember2018-05-012019-04-300001487198aspu:StockOptionGrantsToEmployeesAndDirectorsMember2019-04-300001487198aspu:StockOptionGrantsToEmployeesAndDirectorsMember2019-04-302019-04-300001487198aspu:StockOptionGrantsToEmployeesAndDirectorsMember2019-10-310001487198aspu:StockOptionGrantsToEmployeesAndDirectorsMember2019-10-312019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeOneMember2019-08-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeOneMember2019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeOneMember2019-05-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeTwoMember2019-08-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeTwoMember2019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeTwoMember2019-05-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeThreeMember2019-08-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeThreeMember2019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeThreeMember2019-05-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFourMember2019-08-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFourMember2019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFourMember2019-05-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFiveMember2019-08-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFiveMember2019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeFiveMember2019-05-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSixMember2019-08-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSixMember2019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSixMember2019-05-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSevenMember2019-08-012019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSevenMember2019-10-310001487198aspu:ShareBasedCompensationSharesAuthorizedUnderStockOptionPlansExercisePriceRangeSevenMember2019-05-012019-10-310001487198us-gaap:EmployeeStockOptionMember2019-08-012019-08-010001487198us-gaap:EmployeeStockOptionMember2019-08-010001487198aspu:NonQualifiedStockOptionsToCertainFormerDirectorsMember2019-05-132019-05-130001487198aspu:NonQualifiedStockOptionsToCertainFormerDirectorsMember2019-05-130001487198srt:ExecutiveOfficerMember2019-08-012019-10-310001487198aspu:TuitionRevenueMember2019-08-012019-10-310001487198aspu:TuitionRevenueMember2018-08-012018-10-310001487198aspu:TuitionRevenueMember2019-05-012019-10-310001487198aspu:TuitionRevenueMember2018-05-012018-10-310001487198aspu:CourseFeeRevenueMember2019-08-012019-10-310001487198aspu:CourseFeeRevenueMember2018-08-012018-10-310001487198aspu:CourseFeeRevenueMember2019-05-012019-10-310001487198aspu:CourseFeeRevenueMember2018-05-012018-10-310001487198aspu:BookFeeRevenueMember2019-08-012019-10-310001487198aspu:BookFeeRevenueMember2018-08-012018-10-310001487198aspu:BookFeeRevenueMember2019-05-012019-10-310001487198aspu:BookFeeRevenueMember2018-05-012018-10-310001487198aspu:ExamFeeRevenueMember2019-08-012019-10-310001487198aspu:ExamFeeRevenueMember2018-08-012018-10-310001487198aspu:ExamFeeRevenueMember2019-05-012019-10-310001487198aspu:ExamFeeRevenueMember2018-05-012018-10-310001487198aspu:ServiceFeeRevenueMember2019-08-012019-10-310001487198aspu:ServiceFeeRevenueMember2018-08-012018-10-310001487198aspu:ServiceFeeRevenueMember2019-05-012019-10-310001487198aspu:ServiceFeeRevenueMember2018-05-012018-10-310001487198us-gaap:NonUsMemberus-gaap:SalesRevenueNetMember2019-05-012019-10-310001487198us-gaap:NonUsMemberus-gaap:SalesRevenueNetMember2018-05-012018-10-310001487198us-gaap:SubsequentEventMemberus-gaap:RestrictedStockUnitsRSUMemberaspu:FrankJCotroneoMember2019-12-022019-12-020001487198aspu:RobertAlessiMemberus-gaap:SubsequentEventMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-012019-12-010001487198us-gaap:SubsequentEventMemberus-gaap:RestrictedStockUnitsRSUMemberaspu:FrankJCotroneoMember2019-12-012019-12-010001487198us-gaap:SubsequentEventMemberaspu:JosephSeverlyMember2019-12-152019-12-150001487198us-gaap:SubsequentEventMemberaspu:JosephSeverlyMember2019-12-150001487198us-gaap:RestrictedStockMemberus-gaap:SubsequentEventMemberaspu:JosephSeverlyMember2019-12-150001487198us-gaap:CommonStockMemberus-gaap:SubsequentEventMemberaspu:JosephSeverlyMember2019-12-150001487198us-gaap:SubsequentEventMember2019-11-012019-11-300001487198us-gaap:SubsequentEventMemberus-gaap:RestrictedStockUnitsRSUMember2019-11-012019-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended October 31, 2019

or

| | | | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from ___________ to ___________ |

Commission file number 001-38175

ASPEN GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 27-1933597 | |

| State or Other Jurisdiction of Incorporation or Organization | | I.R.S. Employer Identification No. | |

| | | | |

| 276 Fifth Avenue, Suite 505, New York, New York | | 10001 | |

| Address of Principal Executive Offices | | Zip Code | |

(646) 448-5144

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 | ASPU | The Nasdaq Stock Market (The Nasdaq Global Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

| Large accelerated filer ¨ | Accelerated filer þ |

| Non-accelerated filer ¨ | Smaller reporting company ☑ |

| Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

| | | | | | | | | | | | | | |

| Class | | Outstanding as of December 6, 2019 | |

| Common Stock, $0.001 par value per share | | 19,131,899 shares | |

INDEX

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| October 31, 2019 | | April 30, 2019 |

| (Unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash | $ | 6,472,417 | | | $ | 9,519,352 | |

| Restricted cash | 454,288 | | | 448,400 | |

Accounts receivable, net of allowance of $1,892,318 and $1,247,031, respectively | 12,813,517 | | | 10,656,470 | |

| Prepaid expenses | 788,929 | | | 410,745 | |

| Other receivables | 312 | | | 2,145 | |

| Other current assets | 172,507 | | | — | |

| Total current assets | 20,701,970 | | | 21,037,112 | |

| | | |

| Property and equipment: | | | |

| Call center equipment | 270,010 | | | 193,774 | |

| Computer and office equipment | 345,241 | | | 327,621 | |

| Furniture and fixtures | 1,484,930 | | | 1,381,271 | |

| Software | 5,178,944 | | | 4,314,198 | |

| 7,279,125 | | | 6,216,864 | |

| Less accumulated depreciation and amortization | (2,296,365) | | | (1,825,524) | |

| Total property and equipment, net | 4,982,760 | | | 4,391,340 | |

| Goodwill | 5,011,432 | | | 5,011,432 | |

| Intangible assets, net | 7,991,667 | | | 8,541,667 | |

| Courseware, net | 135,446 | | | 161,930 | |

Accounts receivable, secured - net of allowance of $625,963 and $625,963, respectively | 45,329 | | | 45,329 | |

| Long term contractual accounts receivable | 5,490,733 | | | 3,085,243 | |

| Debt issue cost, net | 250,569 | | | 300,824 | |

| Right of use lease asset | 7,953,283 | | | — | |

| Deposits and other assets | 324,950 | | | 629,626 | |

| | | |

| Total assets | $ | 52,888,139 | | | $ | 43,204,503 | |

(Continued)

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (CONTINUED)

| | | | | | | | | | | |

| October 31, 2019 | | April 30, 2019 |

| (Unaudited) | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,187,748 | | | $ | 1,699,221 | |

| Accrued expenses | 739,661 | | | 651,418 | |

| Deferred revenue | 5,509,861 | | | 2,456,865 | |

| Refunds due students | 1,902,211 | | | 1,174,501 | |

| Deferred rent, current portion | — | | | 47,436 | |

| Convertible note payable | 50,000 | | | 50,000 | |

Senior secured loan payable, net of discount of $218,030 at October 31, 2019 | 9,781,970 | | | — | |

| Operating lease obligations, current portion | 1,509,429 | | | — | |

| Other current liabilities | 28,605 | | | 270,786 | |

| Total current liabilities | 20,709,485 | | | 6,350,227 | |

| | | |

Senior secured loan payable, net of discount of $353,328 at April 30, 2019 | — | | | 9,646,672 | |

| Operating lease obligations | 6,443,854 | | | — | |

| Deferred rent | 767,710 | | | 746,176 | |

| Total liabilities | 27,921,049 | | | 16,743,075 | |

| | | |

| Commitments and contingencies – see Note 10 | | | |

| | | |

| Stockholders’ equity: | | | |

Preferred stock, $0.001 par value; 1,000,000 shares authorized, | | | |

0 issued and outstanding at October 31, 2019 and April 30, 2019 | — | | | — | |

Common stock, $0.001 par value; 40,000,000 shares authorized | | | |

19,142,316 issued and 19,125,649 outstanding at October 31, 2019 | | | |

18,665,551 issued and 18,648,884 outstanding at April 30, 2019 | 19,142 | | | 18,666 | |

| Additional paid-in capital | 69,781,363 | | | 68,562,727 | |

Treasury stock (16,667 shares) | (70,000) | | | (70,000) | |

| Accumulated deficit | (44,763,415) | | | (42,049,965) | |

| Total stockholders’ equity | 24,967,090 | | | 26,461,428 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 52,888,139 | | | $ | 43,204,503 | |

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | | | Six Months Ended

October 31, | | |

| 2019 | | 2018 | | 2019 | | 2018 |

| Revenues | $ | 12,085,965 | | | $ | 8,095,344 | | | | $ | 22,443,947 | | | $ | 15,316,649 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | 4,188,056 | | | 3,835,515 | | | | 8,541,114 | | | 7,587,907 | |

| General and administrative | 7,601,459 | | | 6,210,411 | | | | 14,638,609 | | | 12,034,543 | |

| Depreciation and amortization | 628,225 | | | 524,067 | | | | 1,234,799 | | | 1,022,172 | |

| Total operating expenses | 12,417,740 | | | 10,569,993 | | | | 24,414,522 | | | 20,644,622 | |

| | | | | | | |

| Operating loss | (331,775) | | | (2,474,649) | | | | (1,970,575) | | | (5,327,973) | |

| | | | | | | |

| Other income (expense) | | | | | | | |

| Other income | 132,567 | | | 41,493 | | | | 155,369 | | | 97,894 | |

| Interest expense | (428,960) | | | (41,922) | | | | (852,649) | | | (82,275) | |

| Total other income/(expense), net | (296,393) | | | (429) | | | | (697,280) | | | 15,619 | |

| | | | | | | |

| Loss before income taxes | (628,168) | | | (2,475,078) | | | | (2,667,855) | | | (5,312,354) | |

| | | | | | | |

| Income tax expense | 10,000 | | | — | | | | 45,595 | | | — | |

| | | | | | | |

| Net loss | $ | (638,168) | | | $ | (2,475,078) | | | | $ | (2,713,450) | | | $ | (5,312,354) | |

| | | | | | | |

| Net loss per share allocable to common stockholders - basic and diluted | $ | (0.03) | | | $ | (0.13) | | | $ | (0.14) | | | $ | (0.29) | |

| | | | | | | | | |

| Weighted average number of common stock outstanding - basic and diluted | 18,985,371 | | | 18,335,413 | | | 18,859,344 | | | 18,326,621 | |

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Three Months Ended October 31, 2019 and 2018

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | Additional

Paid-In

Capital | | Treasury

Stock | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | | | | | |

| Balance at July 31, 2019 | 18,913,527 | | | | $ | 18,914 | | | | $ | 69,146,123 | | | | $ | (70,000) | | | | $ | (44,125,247) | | | | $ | 24,969,790 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | | — | | | | 391,067 | | | | — | | | | — | | | | 391,067 | |

| Common stock issued for cashless stock options exercised | 80,313 | | | | 80 | | | | (80) | | | | — | | | | — | | | | — | |

| Common stock issued for stock options exercised for cash | 90,950 | | | | 90 | | | | 192,432 | | | | — | | | | — | | | | 192,522 | |

| Common stock issued for cashless warrant exercise | 57,526 | | | | 58 | | | | (58) | | | | — | | | | — | | | | — | |

| Amortization of warrant based cost | — | | | | — | | | | 9,125 | | | | — | | | | — | | | | 9,125 | |

| Amortization of restricted stock issued for services | — | | | | — | | | | 42,754 | | | | — | | | | — | | | | 42,754 | |

| | | | | | | | | | | |

| Net loss | — | | | | — | | | | — | | | | — | | | | (638,168) | | | | (638,168) | |

| Balance at October 31, 2019 | 19,142,316 | | | | $ | 19,142 | | | | $ | 69,781,363 | | | | $ | (70,000) | | | | $ | (44,763,415) | | | | $ | 24,967,090 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Common Stock | | | | Additional

Paid-In

Capital | | Treasury

Stock | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | | | | | |

| Balance at July 31, 2018 | 18,341,440 | | | | $ | 18,341 | | | | $ | 66,744,959 | | | | $ | (70,000) | | | | $ | (35,609,024) | | | | $ | 31,084,276 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | | — | | | | 305,315 | | | | — | | | | — | | | | 305,315 | |

| Common stock issued for cashless stock options exercised | 25,534 | | | | 26 | | | | (26) | | | | — | | | | — | | | | — | |

| Common stock issued for stock options exercised for cash | 24,118 | | | | 24 | | | | 52,261 | | | | — | | | | — | | | | 52,285 | |

| Net loss | — | | | | — | | | | — | | | | — | | | | (2,475,078) | | | | (2,475,078) | |

| Balance at October 31, 2018 | 18,391,092 | | | | $ | 18,391 | | | | $ | 67,102,509 | | | | $ | (70,000) | | | | $ | (38,084,102) | | | | $ | 28,966,798 | |

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (CONTINUED)

Six Months Ended October 31, 2019 and 2018

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | Additional

Paid-In

Capital | | Treasury

Stock | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | | | | | |

| Balance at April 30, 2019 | 18,665,551 | | | | $ | 18,666 | | | | $ | 68,562,727 | | | | $ | (70,000) | | | | $ | (42,049,965) | | | | $ | 26,461,428 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | | — | | | | 889,484 | | | | — | | | | — | | | | 889,484 | |

| Common stock issued for cashless stock options exercised | 182,207 | | | | 182 | | | | (182) | | | | — | | | | — | | | | — | |

| Common stock issued for stock options exercised for cash | 112,826 | | | | 113 | | | | 237,600 | | | | — | | | | — | | | | 237,713 | |

| Common stock issued for cashless warrant exercise | 76,929 | | | | 77 | | | | (77) | | | | — | | | | — | | | | — | |

| Amortization of warrant based cost | — | | | | — | | | | 18,565 | | | | — | | | | — | | | | 18,565 | |

| Amortization of restricted stock issued for services | — | | | | — | | | | 73,350 | | | | — | | | | — | | | | 73,350 | |

| Restricted Stock Issued for Services, subject to vesting | 104,803 | | | | 104 | | | | (104) | | | | — | | | | — | | | | — | |

| Net loss | — | | | | — | | | | — | | | | — | | | | (2,713,450) | | | | (2,713,450) | |

| Balance at October 31, 2019 | 19,142,316 | | | | $ | 19,142 | | | | $ | 69,781,363 | | | | $ | (70,000) | | | | $ | (44,763,415) | | | | $ | 24,967,090 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Common Stock | | | | Additional

Paid-In

Capital | | Treasury

Stock | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | | | | | |

| Balance at April 30, 2018 | 18,333,521 | | | | $ | 18,334 | | | | $ | 66,557,005 | | | | $ | (70,000) | | | | $ | (32,771,748) | | | | $ | 33,733,591 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | | — | | | | 515,291 | | | | — | | | | — | | | | 515,291 | |

| Common stock issued for cashless stock options exercised | 30,764 | | | | 31 | | | | (31) | | | | — | | | | — | | | | — | |

| Common stock issued for stock options exercised for cash | 26,807 | | | | 26 | | | | 60,076 | | | | — | | | | — | | | | 60,102 | |

| Purchase of treasury stock, net of broker fees | — | | | | — | | | | — | | | | (7,370,000) | | | | — | | | | (7,370,000) | |

| Re-sale of treasury stock, net of broker fees | — | | | | — | | | | — | | | | 7,370,000 | | | | — | | | | 7,370,000 | |

| Fees associated with equity raise | — | | | | — | | | | (29,832) | | | | — | | | | — | | | | (29,832) | |

| Net loss | — | | | | — | | | | — | | | | — | | | | (5,312,354) | | | | (5,312,354) | |

| Balance at October 31, 2018 | 18,391,092 | | | | $ | 18,391 | | | | $ | 67,102,509 | | | | $ | (70,000) | | | | $ | (38,084,102) | | | | $ | 28,966,798 | |

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

October 31, | | |

| | 2019 | | 2018 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (2,713,450) | | | $ | (5,312,354) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Bad debt expense | 648,658 | | | 292,889 | |

| Depreciation and amortization | 1,234,799 | | | 1,022,172 | |

| Stock-based compensation | 889,484 | | | 515,291 | |

| Warrants issued for services | 18,565 | | | — | |

| Loss on asset disposition | 3,918 | | | — | |

| Amortization of debt discounts | 135,298 | | | — | |

| Amortization of debt issue costs | 50,255 | | | — | |

| Amortization of prepaid shares for services | — | | | 8,285 | |

| Non-cash payments to investor relations firm | 73,350 | | | — | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (5,211,195) | | | (4,028,143) | |

| Prepaid expenses | (378,184) | | | (238,951) | |

| Other receivables | 1,833 | | | 179,196 | |

| Other current assets | (172,507) | | | — | |

| Other assets | 304,676 | | | (20,846) | |

| Accounts payable | (511,473) | | | (601,225) | |

| Accrued expenses | 88,243 | | | 72,737 | |

| Deferred rent | (25,902) | | | 453,880 | |

| Refunds due students | 727,710 | | | 366,098 | |

| Deferred revenue | 3,052,996 | | | 1,631,170 | |

| | | |

| Other liabilities | (242,181) | | | 172,378 | |

| Net cash used in operating activities | (2,025,107) | | | (5,487,423) | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of courseware and accreditation | (9,575) | | | (85,821) | |

| Purchases of property and equipment | (1,244,078) | | | (1,345,777) | |

| Net cash used in investing activities | (1,253,653) | | | (1,431,598) | |

| | | |

| Cash flows from financing activities: | | | |

| Disbursements for equity offering costs | — | | | (29,832) | |

| Proceeds of stock options exercised and warrants exercised | 237,713 | | | 60,102 | |

| Purchase of treasury stock, net of broker fees | — | | | (7,370,000) | |

| Re-sale of treasury stock, net of broker fees | — | | | 7,370,000 | |

| Net cash provided by financing activities | 237,713 | | | 30,270 | |

| | | |

| Net (decrease) in cash and cash equivalents | (3,041,047) | | | (6,888,751) | |

| Cash, restricted cash, and cash equivalents at beginning of period | 9,967,752 | | | 14,803,065 | |

| Cash and cash equivalents at end of period | $ | 6,926,705 | | | $ | 7,914,314 | |

| | | |

| Supplemental disclosure cash flow information | | | |

| Cash paid for interest | $ | 652,121 | | | $ | — | |

| Cash paid for income taxes | $ | 49,595 | | | $ | — | |

| | | |

| Supplemental disclosure of non-cash investing and financing activities | | | |

| Common stock issued for services | $ | 178,447 | | | $ | — | |

| Right-of-use lease asset offset against operating lease obligations | $ | 7,469,167 | | | | $ | — | |

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

(Unaudited)

The following table provides a reconciliation of cash and restricted cash reported within the unaudited consolidated balance sheets that sum to the same such amounts shown in the unaudited consolidated statements of cash flows:

| | | | | | | | | | | |

| | | |

| Six Months Ended

October 31, | | |

| 2019 | | 2018 |

| Cash | $ | 6,472,417 | | | | $ | 7,723,808 | |

| Restricted cash | 454,288 | | | | 190,506 | |

| Total cash and restricted cash | $ | 6,926,705 | | | | $ | 7,914,314 | |

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

Note 1. Nature of Operations and Liquidity

Overview

Aspen Group, Inc. (together with its subsidiaries, the “Company,” “Aspen,” or “AGI”) is a holding company, which has three subsidiaries. They are Aspen University Inc. (“Aspen University”) organized in 1987, Aspen Nursing, Inc. (“ANI”) (a subsidiary of Aspen University) formed in October 2018 and United States University, Inc. (“USU”) formed in May 2017. USU was the vehicle we used to acquire United States University on December 1, 2017. (See Note 4). When we refer to USU in this Report, we refer to either the online university which has operated under the name United States University or our subsidiary which operates this university, as the context implies.

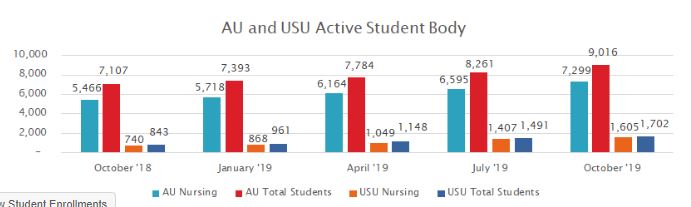

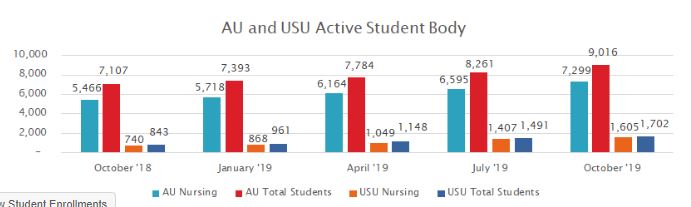

AGI is an education technology holding company that leverages its infrastructure and expertise to allow its two universities, Aspen University and United States University, to deliver on the vision of making college affordable again. Because we believe higher education should be a catalyst to our students’ long-term economic success, we exert financial prudence by offering affordable tuition that is one of the greatest values in higher education. AGI’s primary focus relative to future growth is to target the high growth nursing profession, currently 83% of all students across both universities are degree-seeking nursing students.

Since 1993, Aspen University has been nationally accredited by the Distance Education and Accrediting Council (“DEAC”), a national accrediting agency recognized by the U.S. Department of Education (the “DOE”). In February 2019, the DEAC informed Aspen University that it had renewed its accreditation for five years through January 2024.

Since 2009, USU has been regionally accredited by WASC Senior College and University Commission. (“WSCUC”).

Both universities are qualified to participate under the Higher Education Act of 1965, as amended (HEA) and the Federal student financial assistance programs (Title IV, HEA programs). USU has a provisional certification resulting from the ownership change of control in connection with the acquisition by AGI on December 1, 2017.

Basis of Presentation

Interim Financial Statements

The interim consolidated financial statements included herein have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). In the opinion of the Company’s management, all adjustments (consisting of normal recurring adjustments and reclassifications and non-recurring adjustments) necessary to present fairly our results of operations for the three and six months ended October 31, 2019 and 2018, our cash flows for the six months ended October 31, 2019 and 2018, and our financial position as of October 31, 2019 have been made. The results of operations for such interim periods are not necessarily indicative of the operating results to be expected for the full year.

Certain information and disclosures normally included in the notes to the annual consolidated financial statements have been condensed or omitted from these interim consolidated financial statements. Accordingly, these interim consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the fiscal year ended April 30, 2019 as filed with the SEC on July 9, 2019. The April 30, 2019 balance sheet is derived from those statements.

Liquidity

At October 31, 2019, the Company had a cash balance of $6,472,417 with an additional $454,288 in restricted cash.

On November 5, 2018 the Company entered into a three year, $5,000,000 senior revolving credit facility. There is currently no outstanding balance under that facility. (See Note 6)

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

In March 2019, the Company entered into two loan agreements for a principal amount of $5 million each and received total proceeds of $10 million. In connection with the loan agreements, the Company issued 18 month senior secured promissory notes, with the right to extend the term of the loans for an additional 12 months subject to paying a 1% one-time extension fee. (See Note 6)

During the six months ended October 31, 2019 the Company used net cash of $3,041,047, which included using $2,025,107 in operating activities.

Note 2. Significant Accounting Policies

Principles of Consolidation

The unaudited consolidated financial statements include the accounts of AGI and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the unaudited consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts in the consolidated financial statements. Actual results could differ from those estimates. Significant estimates in the accompanying unaudited consolidated financial statements include the allowance for doubtful accounts and other receivables, the valuation of collateral on certain receivables, estimates of the fair value of assets acquired and liabilities assumed in a business combination, amortization periods and valuation of courseware, intangibles and software development costs, estimates of the valuation of initial right of use ("ROU") assets and corresponding lease liabilities, valuation of beneficial conversion features in convertible debt, valuation of goodwill, valuation of loss contingencies, valuation of stock-based compensation and the valuation allowance on deferred tax assets.

Cash, Cash Equivalents, and Restricted Cash

For the purposes of the unaudited consolidated statements of cash flows, the Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. There were no cash equivalents at October 31, 2019 and April 30, 2019. The Company maintains its cash in bank and financial institution deposits that at times may exceed federally insured limits of $250,000 per financial institution. The Company has not experienced any losses in such accounts from inception through October 31, 2019.

As of October 31, 2019 and April 30, 2019, the Company maintained deposits totaling $6,352,050 and $9,359,208, respectively, held in two separate institutions.

Restricted cash was $454,288 as of October 31, 2019 and consisted of $122,262 which is collateral for a letter of credit issued by the bank and required under the USU facility operating lease. Also, included was $71,932 and an additional $260,094, which was collateral for a letter of credit issued by the bank and related to USU’s receipt of Title IV funds as required by DOE in connection with the change of control of USU. Restricted cash as of April 30, 2019 was $448,400.

Goodwill and Intangibles

Goodwill currently represents the excess of the purchase price of USU over the fair market value of assets acquired and liabilities assumed from Educacion Significativa, LLC. Goodwill has an indefinite life and is not amortized. Goodwill is tested annually for impairment.

Intangible assets represent both indefinite lived and definite lived assets. Accreditation, regulatory approvals, trade name and trademarks are deemed to have indefinite useful lives and accordingly are not amortized but are tested annually for impairment. Student relationships and curriculums are deemed to have definite lives and are amortized accordingly.

Fair Value Measurements

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

Fair value is the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants. The Company classifies assets and liabilities recorded at fair value under the fair value hierarchy based upon the observability of inputs used in valuation techniques. Observable inputs (highest level) reflect market data obtained from independent sources, while unobservable inputs (lowest level) reflect internally developed market assumptions. The fair value measurements are classified under the following hierarchy:

Level 1—Observable inputs that reflect quoted market prices (unadjusted) for identical assets and liabilities in active markets;

Level 2—Observable inputs, other than quoted market prices, that are either directly or indirectly observable in the marketplace for identical or similar assets and liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets and liabilities; and

Level 3—Unobservable inputs that are supported by little or no market activity that are significant to the fair value of assets or liabilities.

The estimated fair value of certain financial instruments, including cash and cash equivalents, accounts receivable, accounts payable and accrued expenses are carried at historical cost basis, which approximates their fair values because of the short-term nature of these instruments.

Accounts Receivable and Allowance for Doubtful Accounts Receivable

All students are required to select both a primary and secondary payment option with respect to amounts due to Aspen for tuition, fees and other expenses. The monthly payment plan represents approximately 66% of the payments that are made by students, making it the most common payment type. In instances where a student selects financial aid as the primary payment option, he or she often selects personal cash as the secondary option. If a student who has selected financial aid as his or her primary payment option withdraws prior to the end of a course but after the date that Aspen’s institutional refund period has expired, the student will have incurred the obligation to pay the full cost of the course. If the withdrawal occurs before the date at which the student has earned 100% of his or her financial aid, Aspen may have to return all or a portion of the Title IV funds to the DOE and the student will owe Aspen all amounts incurred that are in excess of the amount of financial aid that the student earned, and that Aspen is entitled to retain. In this case, Aspen must collect the receivable using the student’s second payment option.

For accounts receivable from students, Aspen records an allowance for doubtful accounts for estimated losses resulting from the inability, failure or refusal of its students to make required payments, which includes the recovery of financial aid funds advanced to a student for amounts in excess of the student’s cost of tuition and related fees. Aspen determines the adequacy of its allowance for doubtful accounts using an allowance method based on an analysis of its historical bad debt experience, current economic trends, and the aging of the accounts receivable and each student’s status. Aspen estimates the amounts to increase the allowance based upon the risk presented by the age of the receivables and student status. Aspen writes off accounts receivable balances at the time the balances are deemed uncollectible. Aspen continues to reflect accounts receivable with an offsetting allowance as long as management believes there is a reasonable possibility of collection.

For accounts receivable from primary payors other than students, Aspen estimates its allowance for doubtful accounts by evaluating specific accounts where information indicates the customers may have an inability to meet financial obligations, such as bankruptcy proceedings and receivable amounts outstanding for an extended period beyond contractual terms. In these cases, Aspen uses assumptions and judgment, based on the best available facts and circumstances, to record a specific allowance for those customers against amounts due to reduce the receivable to the amount expected to be collected. These specific allowances are re-evaluated and adjusted as additional information is received. The amounts calculated are analyzed to determine the total amount of the allowance. Aspen may also record a general allowance as necessary.

Direct write-offs are taken in the period when Aspen has exhausted its efforts to collect overdue and unpaid receivables or otherwise evaluate other circumstances that indicate that Aspen should abandon such efforts. (See Note 8)

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

When a student signs up for the monthly payment plan, there is a contractual amount that the Company can expect to earn over the life of the student’s program. This contractual amount cannot be recorded as an accounts receivable because, the student does have the option to stop attending. As a student takes a class, revenue is earned over the class term. Some students accelerate their program, taking two or more classes every eight week period, which increases the student’s accounts receivable balance. If any portion of that balance will be paid in a period greater than 12 months, that portion is reflected as long-term accounts receivable. At October 31, 2019 and April 30, 2019, those balances were $5,490,733 and $3,085,243, respectively. The Company has determined that the long term accounts receivable do not constitute a significant financing component as the list price, cash selling price and promised consideration are equal. Further, the interest free financing portion of the monthly payment plans are not considered significant to the contract.

Property and Equipment

Property and equipment are recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the related assets per the following table.

| | | | | | | | |

| Category | | Useful Life |

| Call center equipment | | 5 years |

| Computer and office equipment | | 5 years |

| Furniture and fixtures | | 7 years |

| Library (online) | | 3 years |

| Software | | 5 years |

Costs incurred to develop internal-use software during the preliminary project stage are expensed as incurred. Internal-use software development costs are capitalized during the application development stage, which is after: (i) the preliminary project stage is completed; and (ii) management authorizes and commits to funding the project and it is probable the project will be completed and used to perform the function intended. Capitalization ceases at the point the software project is substantially complete and ready for its intended use, and after all substantial testing is completed. Upgrades and enhancements are capitalized if it is probable that those expenditures will result in additional functionality. Depreciation is provided for on a straight-line basis over the expected useful life of five years of the internal-use software development costs and related upgrades and enhancements. When existing software is replaced with new software, the unamortized costs of the old software are expensed when the new software is ready for its intended use.

Leasehold improvements are amortized using the straight-line method over the shorter of the lease term or the estimated useful lives of the leasehold improvements.

Upon the retirement or disposition of property and equipment, the related cost and accumulated depreciation are removed and a gain or loss is recorded in the consolidated statements of operations. Repairs and maintenance costs are expensed in the period incurred.

Courseware and Accreditation

The Company records the costs of courseware and accreditation in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 350 “Intangibles - Goodwill and Other”.

Generally, costs of courseware creation and enhancement are capitalized. Accreditation renewal or extension costs related to intangible assets are capitalized as incurred. Courseware is stated at cost less accumulated amortization. Amortization is provided for on a straight-line basis over the expected useful life of five years.

Long-Lived Assets

The Company assesses potential impairment to its long-lived assets when there is evidence that events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events and circumstances considered by the Company in determining whether the carrying value of identifiable intangible assets and other long-lived assets may not be recoverable include, but are not limited to: significant changes in performance relative to expected operating results, significant

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

changes in the use of the assets, significant negative industry or economic trends, a significant decline in the Company’s stock price for a sustained period of time, and changes in the Company’s business strategy. An impairment loss is recorded when the carrying amount of the long-lived asset is not recoverable and exceeds its fair value. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. Any required impairment loss is measured as the amount by which the carrying amount of a long-lived asset exceeds fair value and is recorded as a reduction in the carrying value of the related asset and an expense to operating results.

Refunds Due Students

The Company receives Title IV funds from the Department of Education to cover tuition and living expenses. After deducting tuition and fees, the Company sends checks for the remaining balances to the students.

Leases

The Company enters into various lease agreements in conducting its business. At the inception of each lease, the Company evaluates the lease agreement to determine whether the lease is an operating or capital lease. Leases may contain initial periods of free rent and/or periodic escalations. When such items are included in a lease agreement, the Company records rent expense on a straight-line basis over the initial term of a lease. The difference between the rent payment and the straight-line rent expense is recorded as additional amortization. The Company expenses any additional payments under its operating leases for taxes, insurance or other operating expenses as incurred.

The Company implemented ASU 2016-2 as of May 1, 2019. There were no material changes to our unaudited consolidated financial statements other than additional assets and off-setting liabilities.

In February 2016, the Financial Accounting Standards Board, of FASB, issued Accounting Standards Update, or ASU, No. 2016-2, Leases (Topic 842). This standard requires entities to recognize most operating leases on their balance sheets as right-of-use assets with a corresponding lease liability, along with disclosing certain key information about leasing arrangements. The Company adopted the standard effective May 1, 2019 using the cumulative effect adjustment transition method, which applies the provisions of the standard at the effective date without adjusting the comparative periods presented. The Company adopted the following practical expedients and elected the following accounting policies related to this standard:

•Carry forward of historical lease classification;

•Short-term lease accounting policy election allowing lessees to not recognize right-of-use assets and lease liabilities for leases with a term of 12 months or less; and

•Not separate lease and non-lease components for office space and campus leases.

The adoption of this standard resulted in the recognition of an initial operating lease right-of-use assets (“ROU’s”) and corresponding lease liabilities of approximately $8.8 million, on the unaudited Consolidated Balance Sheet as of May 1, 2019. There was no impact to the Company’s net income or liquidity as a result of the adoption of this ASU. Additionally, the standard did not materially impact the Company's unaudited consolidated statements of cash flows.

Disclosures related to the amount, timing, and uncertainty of cash flows arising from leases are included in Note 9.

Treasury Stock

Purchases and sales of treasury stock are accounted for using the cost method. Under this method, shares acquired are recorded at the acquisition price directly to the treasury stock account. Upon sale, the treasury stock account is reduced by the original acquisition price of the shares and any difference is recorded in equity. This method does not allow the company to recognize a gain or loss to income from the purchase and sale of treasury stock.

Revenue Recognition and Deferred Revenue

On May 1, 2018, the Company adopted Accounting Standards Codification 606 (ASC 606). ASC 606 is based on the principle that revenue is recognized to depict the transfer of goods or services to customers in an amount that reflects the consideration to

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

which the entity expects to be entitled in exchange for those goods or services. This ASC also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows arising from customer purchase orders, including significant judgments. Our adoption of this ASC, resulted in no change to our results of operations or our balance sheet.

Revenues consist primarily of tuition and course fees derived from courses taught by the Company online as well as from related educational resources and services that the Company provides to its students. Under ASC 606, the tuition and course fee revenue is recognized pro-rata over the applicable period of instruction and are not considered separate performance obligations. Non-tuition related revenue and fees are recognized as services are provided or when the goods are received by the student. (See Note 8)

Cost of Revenues

Cost of revenues consists of two categories, instructional costs and services, and marketing and promotional costs.

Instructional Costs and Services

Instructional costs and services consist primarily of costs related to the administration and delivery of the Company's educational programs. This expense category includes compensation costs associated with online faculty, technology license costs and costs associated with other support groups that provide services directly to the students and are included in cost of revenues.

Marketing and Promotional Costs

Marketing and promotional costs include costs associated with producing marketing materials and advertising. Such costs are generally affected by the cost of advertising media, the efficiency of the Company's marketing and recruiting efforts, and expenditures on advertising initiatives for new and existing academic programs. Non-direct response advertising activities are expensed as incurred, or the first time the advertising takes place, depending on the type of advertising activity. For the three and six months ended October 31, 2019, total marketing and promotional costs was $2,006,989 and $4,216,227, respectively. For the six months ended October 31, 2018, total marketing and promotional costs was $2,248,611 and $4,436,067, respectively.

General and Administrative

General and administrative expenses include compensation of employees engaged in corporate management, finance, human resources, information technology, academic operations, compliance and other corporate functions. General and administrative expenses also include professional services fees, bad debt expense related to accounts receivable, financial aid processing costs, non-capitalizable courseware and software costs, travel and entertainment expenses and facility costs.

Legal Expenses

All legal costs for litigation are charged to expense as incurred.

Income Tax

The Company uses the asset and liability method to compute the differences between the tax basis of assets and liabilities and the related financial statement amounts. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount that more likely than not will be realized. The Company has deferred tax assets and liabilities that reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets are subject to periodic recoverability assessments. Realization of the deferred tax assets, net of deferred tax liabilities, is principally dependent upon achievement of projected future taxable income.

The Company records a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in a tax return. The Company accounts for uncertainty in income taxes using a two-step approach for evaluating tax positions. Step one, recognition, occurs when the Company concludes that a tax position, based solely on its technical merits, is

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

more likely than not to be sustained upon examination. Step two, measurement, is only addressed if the position is more likely than not to be sustained. Under step two, the tax benefit is measured as the largest amount of benefit, determined on a cumulative probability basis, which is more likely than not to be realized upon ultimate settlement. The Company recognizes interest and penalties, if any, related to unrecognized tax benefits in income tax expense.

Stock-Based Compensation

Stock-based compensation expense is measured at the grant date of the award and is expensed over the requisite service period. For employee stock-based awards, the Company calculates the fair value of the award on the date of grant using the Black-Scholes option pricing model. Determining the fair value of stock-based awards at the grant date under this model requires judgment, including estimating volatility, employee stock option exercise behaviors and forfeiture rates. The assumptions used in calculating the fair value of stock-based awards represent the Company's best estimates, but these estimates involve inherent uncertainties and the application of management judgment. For non-employee stock-based awards, the Company has early adopted ASU 2018-7, which substantially aligns share based compensation for employees and non-employees.

Business Combinations

We include the results of operations of businesses we acquire from the date of the respective acquisition. We allocate the purchase price of acquisitions to the assets acquired and liabilities assumed at fair value. The excess of the purchase price of an acquired business over the amount assigned to the assets acquired and liabilities assumed is recorded as goodwill. We expense transaction costs associated with business combinations as incurred.

Net Loss Per Share

Net loss per share of common stock is based on the weighted average number of shares of common stock outstanding during each period. Options to purchase 3,021,131 and 3,435,616 shares of common stock, warrants to purchase 566,223 and 650,847 shares of common stock, unvested restricted stock of 69,672 and 0, and 50,000 and 50,000 of convertible debt (convertible into 4,167 and 4,167 shares of common stock) were outstanding at October 31, 2019 and October 31, 2018, respectively, but were not included in the computation of diluted net loss per share because the effects would have been anti-dilutive. The options, warrants and convertible debt are considered to be common stock equivalents and are only included in the calculation of diluted earnings per share of common stock when their effect is dilutive.

Segment Information

The Company operates in one reportable segment as a single educational delivery operation using a core infrastructure that serves the curriculum and educational delivery needs of its online students regardless of geography. The Company's chief operating decision makers, its Chief Executive Officer and Chief Academic Officer, manage the Company's operations as a whole, and no revenue, expense or operating income information is evaluated by the chief operating decision makers on any component level.

Recent Accounting Pronouncements

Financial Accounting Standards Board, Accounting Standard Updates which are not effective until after October 31, 2019, are not expected to have a significant effect on the Company’s consolidated financial position or results of operations.

Note 3. Property and Equipment

As property and equipment reach the end of their useful lives, the fully expired asset is written off against the associated accumulated depreciation. There is no expense impact for such write offs. Property and equipment consisted of the following at October 31, 2019 and April 30, 2019:

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

| | | | | | | | | | | |

| October 31,

2019 | | April 30,

2019 |

| Call center hardware | $ | 270,010 | | | $ | 193,774 | |

| Computer and office equipment | 345,241 | | | 327,621 | |

| Furniture and fixtures | 1,484,930 | | | 1,381,271 | |

| Software | 5,178,944 | | | 4,314,198 | |

| 7,279,125 | | | 6,216,864 | |

| Accumulated depreciation | (2,296,365) | | | (1,825,524) | |

| Property and equipment, net | $ | 4,982,760 | | | $ | 4,391,340 | |

Software consisted of the following at October 31, 2019 and April 30, 2019:

| | | | | | | | | | | |

| October 31,

2019 | | April 30,

2019 |

| Software | $ | 5,178,944 | | | $ | 4,314,198 | |

| Accumulated depreciation | (1,645,950) | | | (1,351,193) | |

| Software, net | $ | 3,532,994 | | | $ | 2,963,005 | |

Depreciation expense and amortization for all Property and Equipment as well as the portion for just software is presented below for the three and six months ended October 31, 2019 and 2018:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | | | Six Months Ended

October 31, | | |

| 2019 | | 2018 | | 2019 | | 2018 |

| Depreciation and amortization expense | $ | 332,212 | | | $ | 233,109 | | | $ | 648,740 | | | $ | 440,841 | |

| | | | | | | |

| Software amortization expense | $ | 242,797 | | | $ | 160,666 | | | $ | 463,250 | | | $ | 304,440 | |

The following is a schedule of estimated future amortization expense of software at October 31, 2019:

| | | | | | | | |

| | Future Expense |

| 2020 | | $ | 507,808 | |

| 2021 | | 960,396 | |

| 2022 | | 870,922 | |

| 2023 | | 710,683 | |

| 2024 | | 421,401 | |

| Thereafter | | 61,784 | |

| Total | | $ | 3,532,994 | |

Note 4. USU Goodwill and Intangibles

On December 1, 2017, USU acquired United States University and assumed certain liabilities from Educacion Significativa, LLC (“ESL”). USU is a wholly owned subsidiary of AGI and was formed for the purpose of completing the asset purchase transaction. For purposes of purchase accounting, AGI is referred to as the acquirer. AGI acquired the assets and assumed certain liabilities of ESL.

The acquisition was accounted for by AGI in accordance with the acquisition method of accounting pursuant to ASC 805 “Business Combinations” and pushdown accounting was applied to record the fair value of the assets acquired and liabilities assumed on United States University, Inc. Under this method, the purchase price is allocated to the identifiable assets acquired and liabilities assumed based on their estimated fair values at the date of acquisition. The excess of the amount paid over the estimated fair values of the identifiable net assets was $5,011,432 which has been reflected in the consolidated balance sheet as goodwill.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

The goodwill resulting from the acquisition may become deductible for tax purposes in the future. The goodwill resulting from the acquisition is principally attributable to the future earnings potential associated with enrollment growth and other intangibles that do not qualify for separate recognition such as the assembled workforce.

We have selected an April 30th annual goodwill impairment test date.

We assigned an indefinite useful life to the accreditation and regulatory approvals and the trade name and trademarks as we believe they have the ability to generate cash flows indefinitely. In addition, there are no legal, regulatory, contractual, economic or other factors to limit the intangibles’ useful life and we intend to renew the intangibles, as applicable, and renewal can be accomplished at little cost. We determined all other acquired intangibles are finite-lived and we are amortizing them on either a straight-line basis or using an accelerated method to reflect the pattern in which the economic benefits of the assets are expected to be consumed. Amortization expense for six months ended October 31, 2019 and for the year ended April 30, 2019 were $550,000 and $1,100,000, respectively.

Intangible assets consisted of the following at October 31, 2019 and April 30, 2019:

| | | | | | | | | | | |

| October 31,

2019 | | April 30,

2019 |

| Intangible assets | $ | 10,100,000 | | | $ | 10,100,000 | |

| Accumulated amortization | (2,108,333) | | | (1,558,333) | |

| Net intangible assets | $ | 7,991,667 | | | $ | 8,541,667 | |

Note 5. Courseware and Accreditation

Courseware costs capitalized were $7,325 for the six months ended October 31, 2019 and $34,422 for the year ended April 30, 2019. As courseware reaches the end of its useful life, it is written off against the accumulated amortization. There is no expense impact for such write-offs.

Courseware consisted of the following at October 31, 2019 and April 30, 2019:

| | | | | | | | | | | |

| October 31,

2019 | | April 30,

2019 |

| Courseware | $ | 283,538 | | | $ | 325,987 | |

| Accreditation | 59,350 | | | 57,100 | |

| Accumulated amortization | (207,442) | | | (221,157) | |

| Courseware, net | $ | 135,446 | | | $ | 161,930 | |

The Company had capitalized accreditation costs of $2,250 and $57,100 for the six months ended October 31, 2019 and year ended April 30, 2019, respectively.

Amortization expense of courseware for the three and six months ended October 31, 2019 and 2018:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | | | Six Months Ended

October 31, | | |

| 2019 | | 2018 | | 2019 | | 2018 |

| Amortization expense | $ | 16,917 | | | $ | 15,960 | | | $ | 36,059 | | | | $ | 31,331 | |

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

The following is a schedule of estimated future amortization expense of courseware at October 31, 2019:

| | | | | | | | |

| | Future Expense |

| 2020 (remaining) | | $ | 28,824 | |

| 2021 | | 38,560 | |

| 2022 | | 30,673 | |

| 2023 | | 25,133 | |

| 2024 | | 12,256 | |

| Thereafter | | — | |

| Total | | $ | 135,446 | |

Note 6. Debt

Convertible Note

On February 29, 2012, a loan payable of $50,000 was converted into a two-year convertible promissory note, interest of 0.19% per annum. Beginning March 31, 2012, the note was convertible into shares of common stock of the Company at the conversion price of $12.00 per share (taking into account the one-for-12 reverse stock split of the Company’s common stock). The Company evaluated the convertible note and determined that, for the embedded conversion option, there was no beneficial conversion value to record as the conversion price is considered to be the fair market value of the common stock on the note issue date. This loan (now a convertible promissory note) was due in February 2014. The amount due under this note has been reserved for payment upon the note being tendered to the Company by the note holder. However, this $50,000 note is derived from $200,000 of loans made to Aspen University prior to 2011. No disclosure was made of these loans in connection with the merger of Aspen University and EGC, the acquisition vehicle led by Michael Mathews, the Company’s current Chairman and Chief Executive Officer. The bankruptcy judge in the HEMG bankruptcy proceedings has recently ruled that the Company may pursue remedies for these undisclosed loans.

Revolving Credit Facility

On November 5, 2018, the Company entered into a loan agreement (the “Credit Facility Agreement”) with the Leon and Toby Cooperman Family Foundation (the “Foundation”). The Credit Facility Agreement provides for a $5,000,000 revolving credit facility (the “Facility”) evidenced by a revolving promissory note (the “Revolving Note”). Borrowings under the Credit Facility Agreement will bear interest at 12% per annum. The Facility matures on November 4, 2021.

Pursuant to the terms of the Credit Facility Agreement, the Company paid to the Foundation a $100,000 one-time upfront Facility fee. The Company also is paying the Foundation a commitment fee, payable quarterly at the rate of 2% per annum on the undrawn portion of the Facility. As of October 31, 2019, the Company has not borrowed any sum under the Facility.

The Credit Facility Agreement contains customary representations and warranties, events of default and covenants. Pursuant to the Loan Agreement and the Revolving Note, all future or contemporaneous indebtedness incurred by the Company, other than indebtedness expressly permitted by the Credit Facility Agreement and the Revolving Note, and the senior term loans described below will be subordinated to the Facility.

Pursuant to the Credit Facility Agreement, on November 5, 2018 the Company issued to the Foundation warrants to purchase 92,049 shares of the Company’s common stock exercisable for five years from the date of issuance at the exercise price of $5.85 per share which were deemed to have a relative fair value of $255,071. The relative fair value of the warrants along with the Facility fee were treated as debt issue costs, as the facility has not been drawn on, assets to be amortized over the term of the loan.

On March 6, 2019, in connection with entering into the Senior Secured Loans, the Company amended and restated the Credit Facility Agreement (the “Amended and Restated Facility Agreement”) and the Revolving Note. The Amended and Restated

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

Facility Agreement provides among other things that the Company’s obligations thereunder are secured by a first priority lien in the Collateral, on a pari passu basis with the Lenders.

Senior Secured Term Loans

On March 6, 2019, the Company entered into two loan agreements (each a “Loan Agreement” and together, the “Loan Agreements”) with the Foundation, of which Mr. Leon Cooperman, a stockholder of the Company, is the trustee, and another stockholder of the Company (each a “Lender” and together, the “Lenders”). Each Loan Agreement provides for a $5,000,000 term loan (each a “Loan” and together, the “Loans”), evidenced by a term promissory note and security agreement (each a “Term Note” and together, the “Term Notes”), for combined total proceeds of $10,000,000 million. The Company borrowed $5,000,000 from each Lender that day. The Term Notes bear interest at 12% per annum and mature on September 6, 2020, subject to one 12-month extension upon the Company’s option, and upon payment of a 1% one-time extension fee.

Pursuant to the Loan Agreements and the Term Notes, all future or contemporaneous indebtedness incurred by the Company, other than indebtedness expressly permitted by the Loan Agreements and the Term Notes, will be subordinated to the Loans.

The Company’s obligations under the Loan Agreements are secured by a first priority lien in certain deposit accounts of the Company, all current and future accounts receivable of Aspen University and USU, certain of the deposit accounts of Aspen University and USU, and all of the outstanding capital stock of Aspen University and USU (the “Collateral”).

Pursuant to the Loan Agreements, on March 6, 2019 the Company issued to each Lender warrants to purchase 100,000 shares of the Company’s common stock exercisable for five years from the date of issuance at the exercise price of $6.00 per share. The two warrants were deemed to have a combined relative fair value of $360,516. The relative fair value along with closing costs of $33,693 were treated as debt discounts to be amortized over the term of the Loans.

On March 6, 2019, in connection with entering into the Loan Agreements, the Company also entered into an intercreditor agreement (the “Intercreditor Agreement”) among the Company, the Lenders and the Foundation, individually. The Intercreditor Agreement provides among other things that the Company’s obligations under this agreement, and the security interests in the Collateral granted pursuant to, the Loan Agreements and the Amended and Restated Facility Agreement shall rank pari passu to one another.

Note 7. Stockholders’ Equity

Preferred Stock

On June 28, 2019, the Company amended its Certificate of Incorporation, as amended, to reduce in the number of shares of common stock the Company is authorized to issue from 250,000,000 to 40,000,000 shares, and the number of shares of preferred stock the Company is authorized to issue from 10,000,000 to 1,000,000 shares. The stockholders of the Company had previously approved the Amendment at a special meeting of stockholders held on June 28, 2019.

The Company is authorized to issue 1,000,000 shares of “blank check” preferred stock with designations, rights and preferences as may be determined from time to time by our Board of Directors. As of October 31, 2019 and April 30, 2019, we had no shares of preferred stock issued and outstanding.

Common Stock

The Company is authorized to issue 40,000,000 shares of common stock.

During the three months ended October 31, 2019, the Company issued 80,313 shares of common stock upon the cashless exercise of stock options.

During the three months ended October 31, 2019, the Company issued 57,526 shares of common stock upon the cashless exercise of 121,070 warrants.

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2019

(Unaudited)

During the three months ended October 31, 2019, the Company issued 90,950 shares of common stock upon the exercise of stock options for cash and received proceeds of $192,522.

During the three months ended July 31, 2019, the Company issued 101,894 shares of common stock upon the cashless exercise of stock options.

During the three months ended July 31, 2019, the Company issued 19,403 shares of common stock upon the cashless exercise of 43,860 warrants.

During the three months ended July 31, 2019, the Company issued 21,876 shares of common stock upon the exercise of stock options for cash and received proceeds of $45,190.

Restricted Stock

There were 69,672 unvested shares of restricted common stock outstanding at October 31, 2019. Total unrecognized compensation expense related to the unvested restricted stock as of October 31, 2019 amounted to approximately $249,000 which will be amortized over the remaining vesting periods.

During the three months ended July 31, 2019, the Company issued 30,131 shares of restricted common stock to certain directors with a fair value of $122,332.