Investor PresentationNasdaq: ASPU November 2018 1 Aspen Group, Inc. is an education technology holding company that leverages its infrastructure and expertise to allow its two universities, Aspen University and United States University, to deliver on the vision of making college affordable again.

2 Safe Harbor Statement Certain statements in this presentation and responses to various questions include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our expected enrollment conversion rates, the expected recurring revenue from the monthly payment plan contracts, and our projected annual revenue rate per campus. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include the continued effectiveness of our online marketing, how students react to our hybrid pre-licensure BSN program over time, and the Company’s ability to enter into partnerships with health care organizations to establish new campuses and/or finance those campuses. Further information on our risk factors is contained in our filings with the SEC, including the Form 10-K for the fiscal year ended April 30, 2018 filed on July 13, 2018. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Regulation G - Non-GAAP Financial Measures This presentation includes a discussion of Adjusted EBITDA, a non-GAAP financial measure. Certain information regarding these non-GAAP financial measures (including reconciliations to GAAP) is provided on the Investor Relations section of the Aspen website at www.aspu.com.

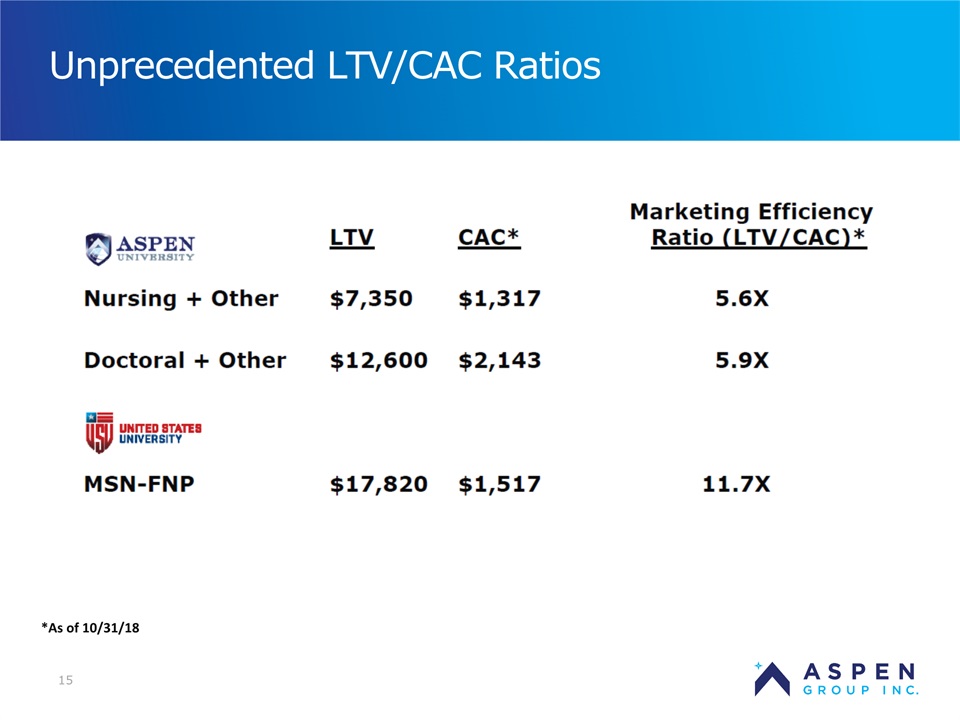

3 Aspen Group: Why We Are A Compelling Investment Disruptive business model (monthly payment plans, no interest) with outstanding student outcomesBest-in-Class EdTech infrastructure (Proprietary SIS & CRM, integrated with LMS)Recurring revenue model (70% of active students paying monthly, delivering >$1.3 million of monthly cash receipts)Unprecedented LTV/CAC ratios (5.6X – 11.7X)Already proven business modelProven management team

Disruptive Business Model:Making College Affordable with Outstanding Student Outcomes 4

5 Aspen Group’s Disruptive Business Model:“Making College Affordable” Offer world class online education at half the cost of our competitors; committed to cash-based, monthly payment plans (no interest) Online Bachelor-level students pay $250/monthOnline Master-level students pay $325/monthOnline Doctoral-level and USU MSN-FNP students pay $375/month

6 Student Outcomes Key to Our Success Student Satisfaction 92.4%*Upon completing their studies, % of alumni that responded they achieved the goals they had when they started the course or program *Aspen University Alumni Survey (http://s3.amazonaws.com/ASPU/Documents/DEAC_Consumer_Information_Disclosure.pdf)

7 Student Outcomes Key to Our Success Graduation Rates** RN to BSN Program (Aspen University’s Largest Degree Program) 76%**As reported to DEAC (Aspen University’s accreditor) for CY’2017 (http://s3.amazonaws.com/ASPU/Documents/DEAC_Consumer_Information_Disclosure.pdf)** https://nces.ed.gov/programs/coe/indicator_ctr.asp (as compared to the national average of 60% of students who began seeking a bachelor’s degree at a 4-year institution in fall 2010 completed that degree within 6 years)

8 Student Outcomes Key to Our Success Financial Prudence 84.3%*% of alumni that graduated without taking afederal loan while attending Aspen University *Based on 1,564 Aspen University graduates between 2017-2018

Primarily Targeting the High Growth Nursing Profession 9

10 RN Employment Projected to Grow 15% in Next Decade It's the best time to be a nurse in the U.S. Melody HahmSenior WriterYahoo Finance August 9, 2018 Being a nurse in the U.S. is a lucrative gig.In the U.S., a nurse earns an average annual salary of $63,000, more than double the global average of $26,698, according to CapRelo, a firm that specializes in global relocation. The U.S. led in average salary for nurses among 43 countries. Certified Registered Nurse Anesthetists (CRNA) earn, on average, $140,934 per year, making it the top paying nursing speciality, according to PayScale.It may very well be the best time to be a nurse in the U.S.. The job’s strong demand, relatively high pay, rewarding nature and low-risk of automation are all compelling incentives to pursue the career. The demand for health care workersThe landscape looks rosy for anyone looking to become a nurse. A recent study by HR consulting firm Mercer found that the U.S. needs to hire 2.3 million new health care workers by 2025 to aid the country’s aging population. While the U.S. added fewer jobs than expected last month, health care employment grew by 286,000 over the year. Hospitals added 7,000 jobs in July, according to BLS numbers. The business services sector added 51,000 jobs and the manufacturing industry added 37,000 jobs in July, coming in distant second and third for top industry job creators.“If you look at the employment projections, health care occupations in general are going to be high in demand over the next decade. Nurses do appear to be really satisfied with their jobs — more than one might expect,” said Martha Gimbel, research director for Indeed’s Hiring Lab. While the nursing field has a wide range of professions, registered nurses make up the largest segment of health care workers.Employment of registered nurses is projected to grow 15% from 2016 to 2026, much faster than the average for all occupations.

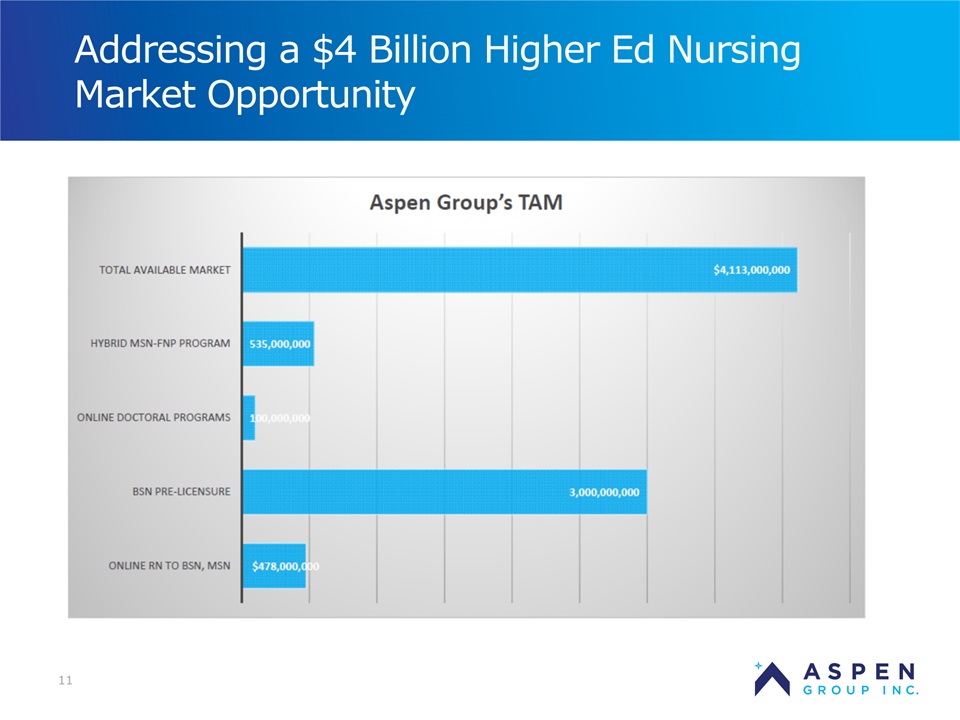

11 Addressing a $4 Billion Higher Ed Nursing Market Opportunity

EdTech Infrastucture Driving Industry Leading Operational Efficiency 12

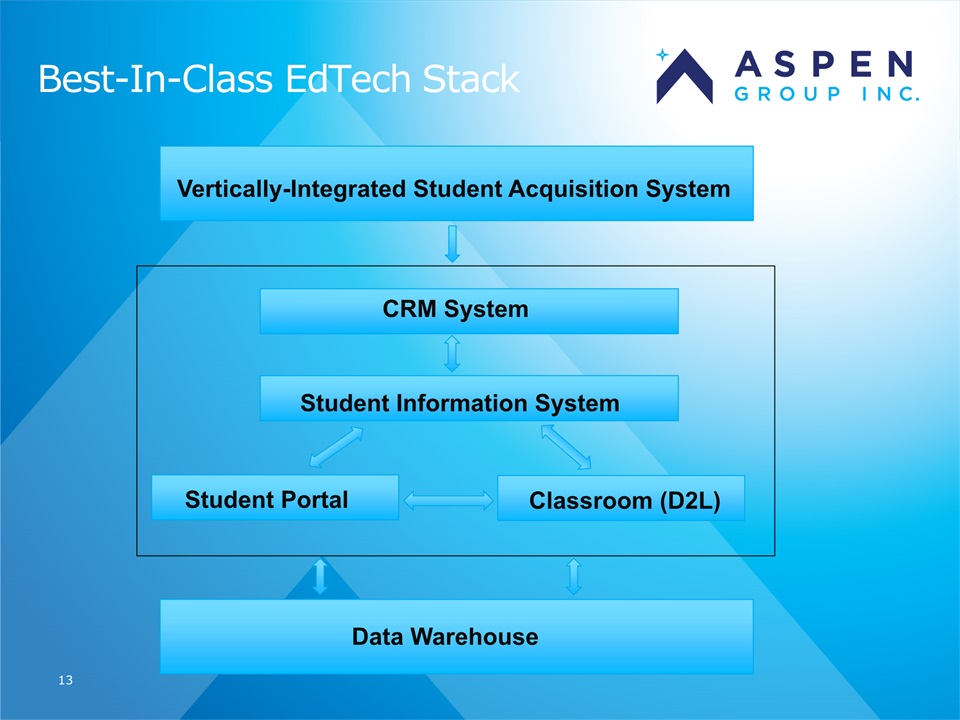

13 Student Information System Data Warehouse CRM System Classroom (D2L) Best-In-Class EdTech Stack Student Portal Vertically-Integrated Student Acquisition System

14 Proprietary CRM System Delivers Breakthrough Functionality Built to achieve highest enrollment conversion rates through recommendation engine algorithmInnovating in student services to drive higher persistence rates; alert Academic Advisors of ‘At-Risk’ events in real-time (launch mid-2019) Academic Financial Time Management Personal Etc.

15 Unprecedented LTV/CAC Ratios *As of 10/31/18

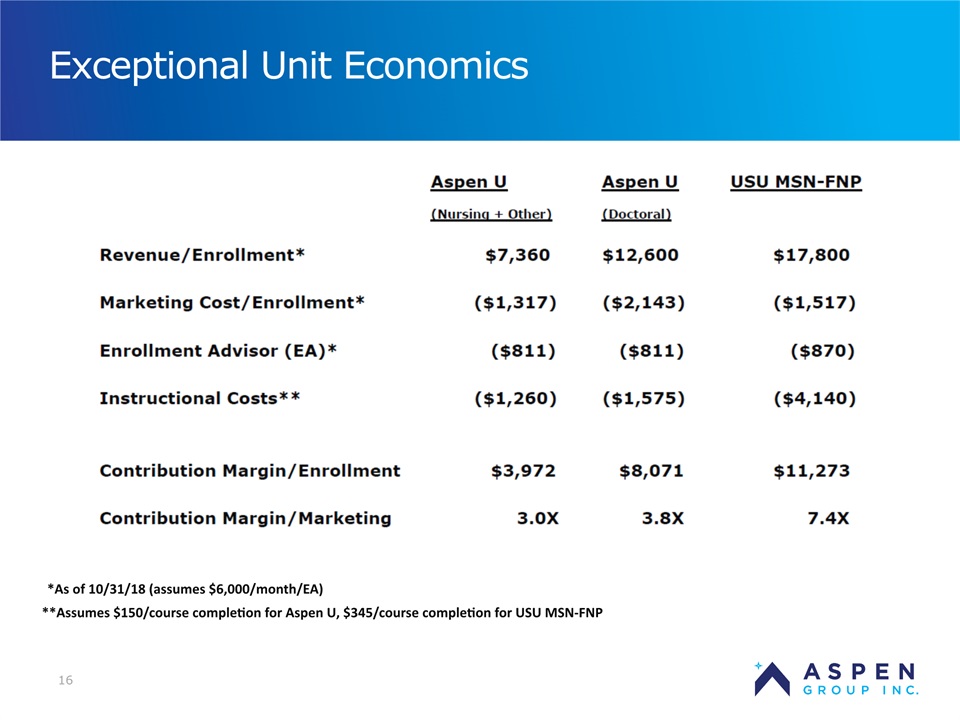

16 Exceptional Unit Economics *As of 10/31/18 (assumes $6,000/month/EA)**Assumes $150/course completion for Aspen U, $345/course completion for USU MSN-FNP

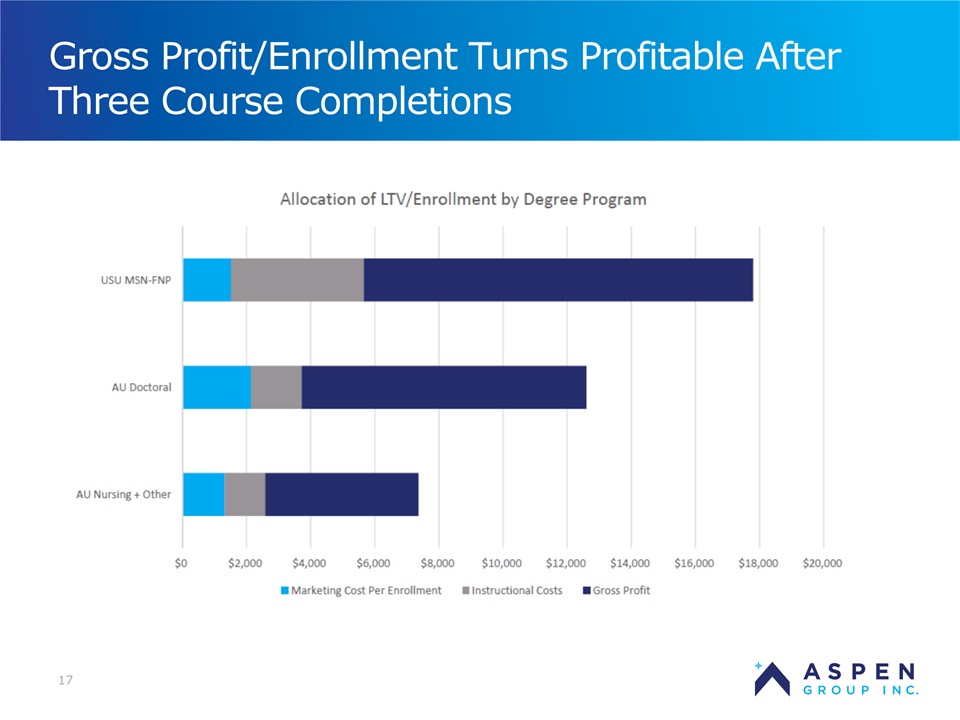

17 Gross Profit/Enrollment Turns Profitable After Three Course Completions

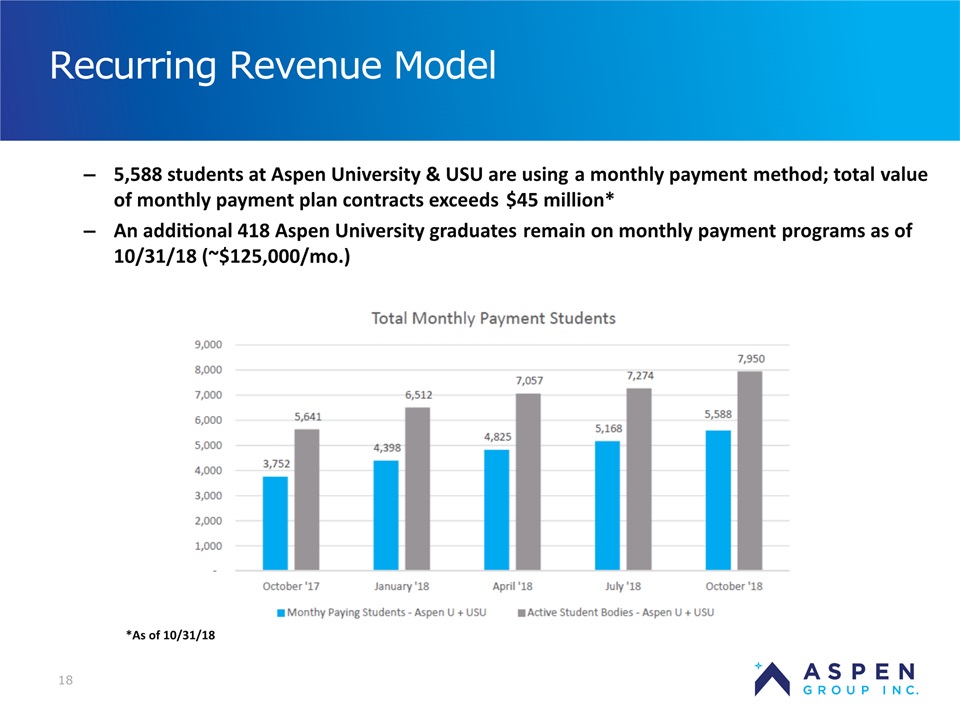

18 Recurring Revenue Model 5,588 students at Aspen University & USU are using a monthly payment method; total value of monthly payment plan contracts exceeds $45 million*An additional 418 Aspen University graduates remain on monthly payment programs as of 10/31/18 (~$125,000/mo.) *As of 10/31/18

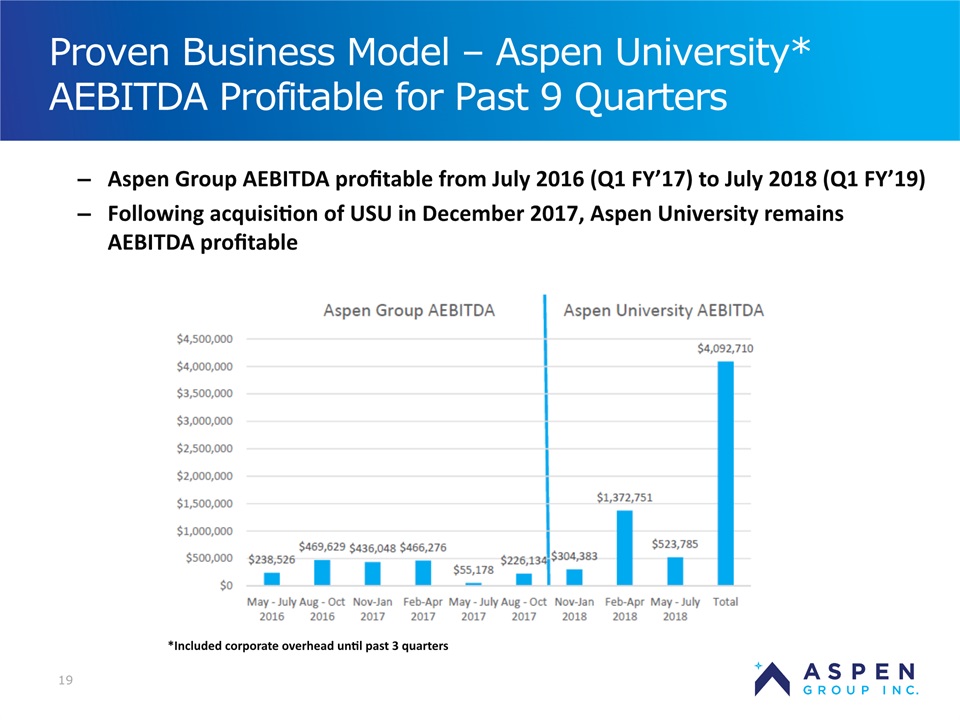

19 Proven Business Model – Aspen University* AEBITDA Profitable for Past 9 Quarters Aspen Group AEBITDA profitable from July 2016 (Q1 FY’17) to July 2018 (Q1 FY’19)Following acquisition of USU in December 2017, Aspen University remains AEBITDA profitable *Included corporate overhead until past 3 quarters

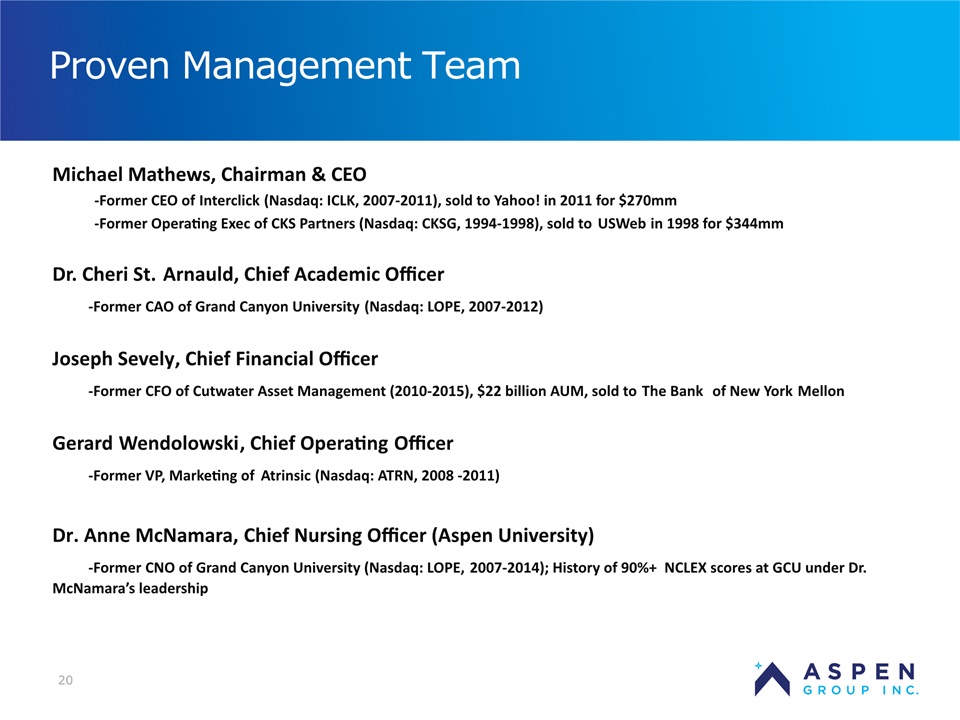

20 Proven Management Team Michael Mathews, Chairman & CEO-Former CEO of Interclick (Nasdaq: ICLK, 2007-2011), sold to Yahoo! in 2011 for $270mm-Former Operating Exec of CKS Partners (Nasdaq: CKSG, 1994-1998), sold to USWeb in 1998 for $344mmDr. Cheri St. Arnauld, Chief Academic Officer -Former CAO of Grand Canyon University (Nasdaq: LOPE, 2007-2012)Joseph Sevely, Chief Financial Officer -Former CFO of Cutwater Asset Management (2010-2015), $22 billion AUM, sold to The Bank of New York MellonGerard Wendolowski, Chief Operating Officer -Former VP, Marketing of Atrinsic (Nasdaq: ATRN, 2008 -2011)Dr. Anne McNamara, Chief Nursing Officer (Aspen University) -Former CNO of Grand Canyon University (Nasdaq: LOPE, 2007-2014); History of 90%+ NCLEX scores at GCU under Dr. McNamara’s leadership

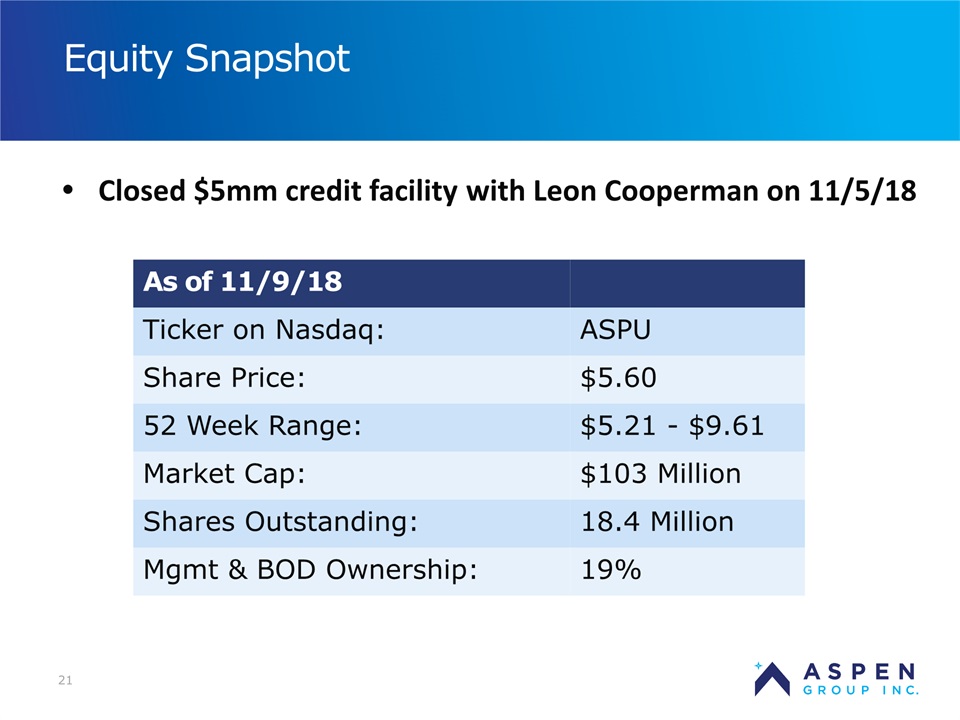

21 Equity Snapshot Closed $5mm credit facility with Leon Cooperman on 11/5/18 As of 11/9/18 Ticker on Nasdaq: ASPU Share Price: $5.60 52 Week Range: $5.21 - $9.61 Market Cap: $103 Million Shares Outstanding: 18.4 Million Mgmt & BOD Ownership: 19%

Appendix 22

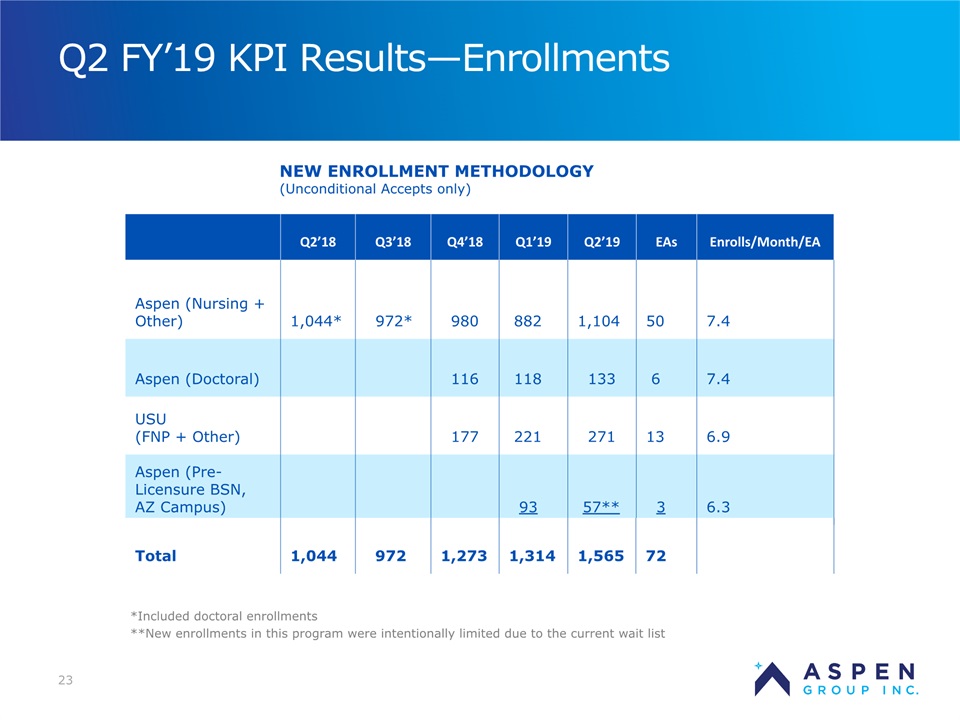

Q2 FY’19 KPI Results—Enrollments 23 *Included doctoral enrollments**New enrollments in this program were intentionally limited due to the current wait list Q2’18 Q3’18 Q4’18 Q1’19 Q2’19 EAs Enrolls/Month/EA Aspen (Nursing + Other) 1,044* 972* 980 882 1,104 50 7.4 Aspen (Doctoral) 116 118 133 6 7.4 USU (FNP + Other) 177 221 271 13 6.9 Aspen (Pre-Licensure BSN, AZ Campus) 93 57** 3 6.3 NEW ENROLLMENT METHODOLOGY (Unconditional Accepts only) Total 1,044 972 1,273 1,314 1,565 72

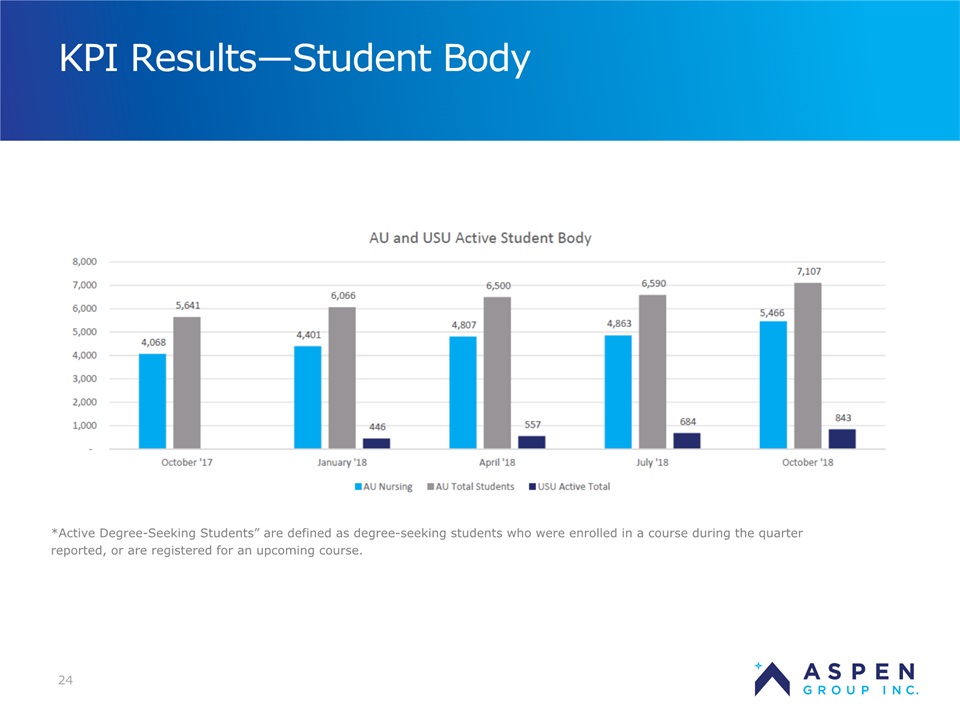

KPI Results—Student Body 24 *Active Degree-Seeking Students” are defined as degree-seeking students who were enrolled in a course during the quarter reported, or are registered for an upcoming course.

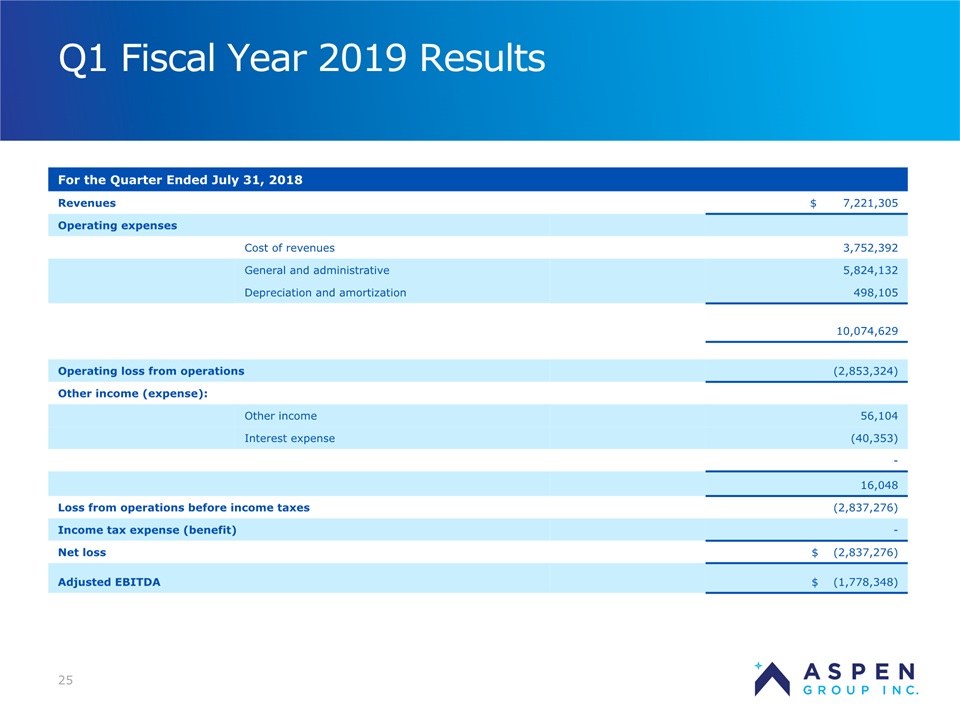

Q1 Fiscal Year 2019 Results 25 For the Quarter Ended July 31, 2018 Revenues $ 7,221,305 Operating expenses Cost of revenues 3,752,392 General and administrative 5,824,132 Depreciation and amortization 498,105 10,074,629 Operating loss from operations (2,853,324) Other income (expense): Other income 56,104 Interest expense (40,353) - 16,048 Loss from operations before income taxes (2,837,276) Income tax expense (benefit) - Net loss $ (2,837,276) Adjusted EBITDA $ (1,778,348)

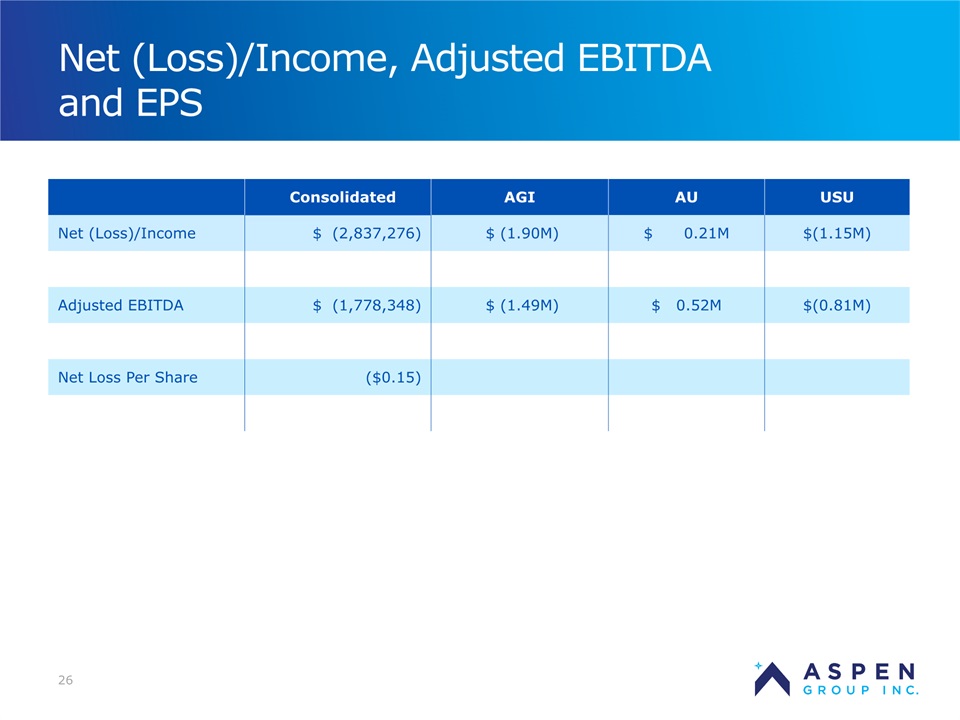

Net (Loss)/Income, Adjusted EBITDA and EPS 26 Consolidated AGI AU USU Net (Loss)/Income $ (2,837,276) $ (1.90M) $ 0.21M $(1.15M) Adjusted EBITDA $ (1,778,348) $ (1.49M) $ 0.52M $(0.81M) Net Loss Per Share ($0.15)

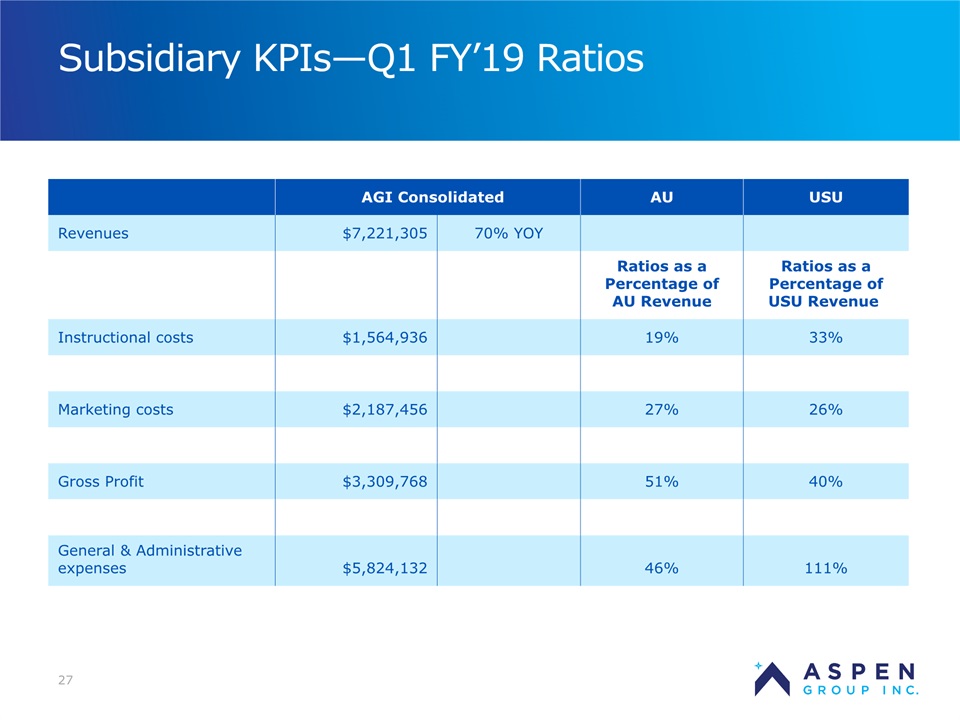

Subsidiary KPIs—Q1 FY’19 Ratios 27 AGI Consolidated AU USU Revenues $7,221,305 70% YOY Ratios as a Percentage of AU Revenue Ratios as a Percentage of USU Revenue Instructional costs $1,564,936 19% 33% Marketing costs $2,187,456 27% 26% Gross Profit $3,309,768 51% 40% General & Administrative expenses $5,824,132 46% 111%

28 Targeting Four Growth Vectors

29 Growth Vector 1: RNs - Fully OnlineRN to BSN & MSN RNs (post-licensure):BSN & MSN2.9mm RNs in U.S. Today65,000 Starts per Annum(TAM: - $478mm)**Assumes Aspen’s $7,350 LTV

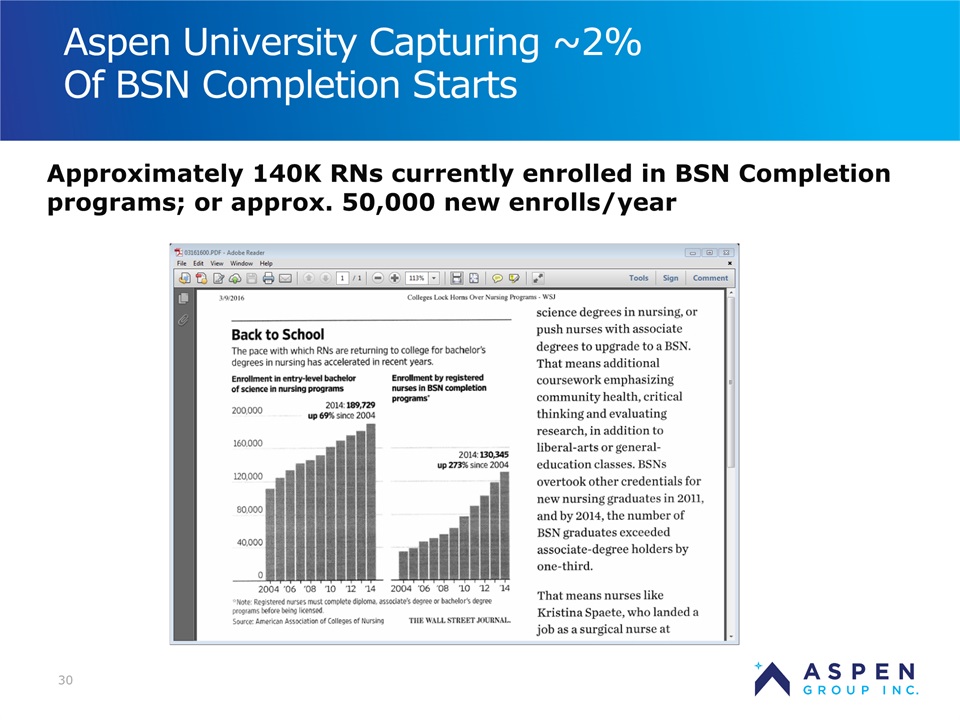

30 Aspen University Capturing ~2%Of BSN Completion Starts Approximately 140K RNs currently enrolled in BSN Completion programs; or approx. 50,000 new enrolls/year

31 Growth Vector 2: Pre-Licensure BSN Hybrid Online/Campus Program Pre-Licensure BSN Program:(Hybrid Online/Campus Program)100,000 Pre-Licensure BSN Startsper Annum(TAM: - $3B)**Assumes an $30,000 LTV

32 Aspen University Pre-Licensure BSN: LaunchedFirst campus in Phoenix in July, 2018 3-Year BSN program is 120 credits – 69% online, 31% on groundApproved by the AZ BON, AZPPSE, State of Colorado, DEACHave clinical partnerships in PHX (Maricopa Integrated Health System, Honor Health, Phoenix Children’s Hospital)Unique compared to other 120-credit pre-licensure BSN programsMajority of courses onlineTotal cost of attendance (tuition + fees) <$50,0009 strategically placed seminars throughout programAttitudes and behaviorsConnecting all content together with expertsFirst Semester (and academic year) already at capacity; just announced night/weekend program starting January, 2019 Forecasting $10mm+ Annual Revenue Run Rate Per Campus, 4-5 Years Out

33 Growth Vector 3: Doctoral Students – Fully Online Doctoral Programs (Fully Online):55,000 Graduates per Annum14% Online Students or ~8K/yr.(TAM: - $100mm)**Assumes Aspen’s $12,600 LTV

34 Growth Vector 4: RNs – MSN/FNP Hybrid Online Program USU goal to become the university of choice for preparing six-figure Nurse Practitioners ($27K: $375 for 72 months) RNs (post-licensure):MSN-Family Nurse Practitioner (Hybrid Online Program)234,000 NPs in U.S. Today (8% oftotal RNs)30,000 Starts per Annum (online/hybrid and campus-based programs) (TAM: - $535mm)**Assumes USU’s $17,820 LTV

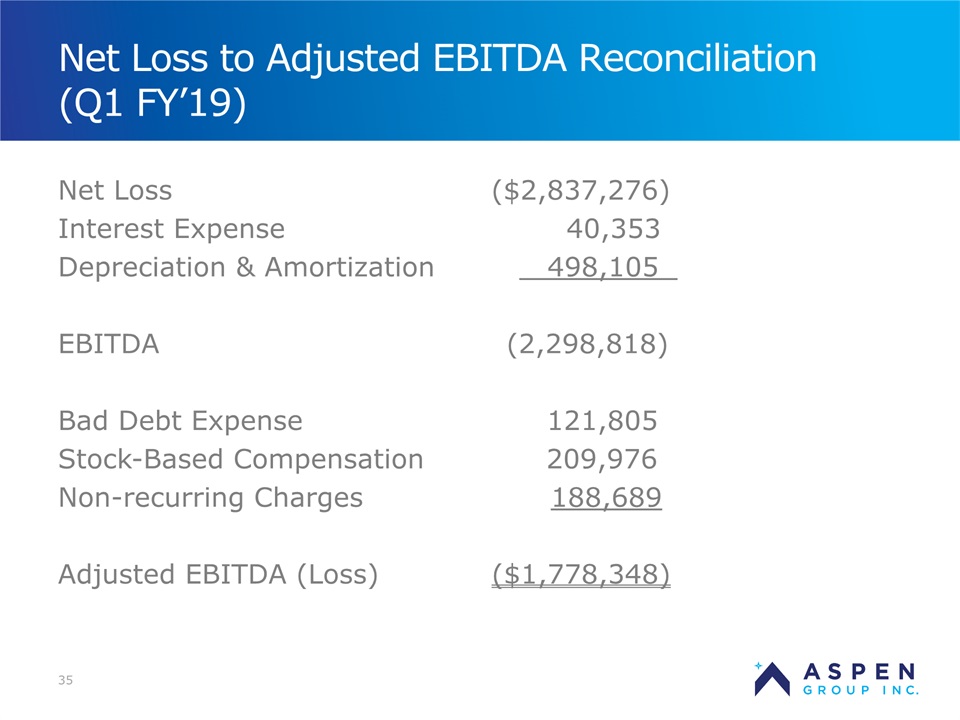

Net Loss to Adjusted EBITDA Reconciliation(Q1 FY’19) Net Loss ($2,837,276)Interest Expense 40,353 Depreciation & Amortization 498,105 EBITDA (2,298,818) Bad Debt Expense 121,805Stock-Based Compensation 209,976Non-recurring Charges 188,689Adjusted EBITDA (Loss) ($1,778,348) 35