Non-Deal RoadshowAugust, 2018Nasdaq: ASPU 1

Non-Deal RoadshowJuly, 2018Nasdaq: ASPU 1

2 Certain statements in this presentation and responses to various questions include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our low customer acquisition costs and teaching costs creating favorable gross margins, our projected annual revenue rate per campus, and the declining cost of enrollment based on raising the limit of FNP enrollments. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include the continued effectiveness of our online marketing, the ability to hold academic teaching costs in line, how students react to our hybrid pre-licensure program over time, and the company’s ability to enter into partnerships with hospitals to establish new campuses and/or finance those campuses. Further information on our risk factors is contained in our filings with the SEC, including the 10-K dated July 13, 2018 and our prospectus supplement dated July 19, 2018. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Regulation G - Non-GAAP Financial Measures This presentation includes a discussion of Adjusted EBITDA and Adjusted Gross Margins, non-GAAP financial measures. Certain information regarding these non-GAAP financial measures (including reconciliations to GAAP) is provided on the Investor Relations section of the Aspen website at www.ir.aspen.edu. Safe Harbor Statement

2 Certain statements in this presentation and responses to various questions include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our low customer acquisition costs and teaching costs creating favorable gross margins, our projected annual revenue rate per campus, and the declining cost of enrollment based on raising the limit of FNP enrollments. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include the continued effectiveness of our online marketing, the ability to hold academic teaching costs in line, how students react to our hybrid pre-licensure program over time, and the company’s ability to enter into partnerships with hospitals to establish new campuses and/or finance those campuses. Further information on our risk factors is contained in our filings with the SEC, including the 10-K dated July 13, 2018. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Regulation G - Non-GAAP Financial Measures This presentation includes a discussion of Adjusted EBITDA and Adjusted Gross Margins, non-GAAP financial measures. Certain information regarding these non-GAAP financial measures (including reconciliations to GAAP) is provided on the Investor Relations section of the Aspen website at www.ir.aspen.edu. Safe Harbor Statement

2 Certain statements in this presentation and responses to various questions include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our low customer acquisition costs and teaching costs creating favorable gross margins, our projected annual revenue rate per campus, and the declining cost of enrollment based on raising the limit of FNP enrollments. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include the continued effectiveness of our online marketing, the ability to hold academic teaching costs in line, how students react to our hybrid pre-licensure program over time, and the company’s ability to enter into joint ventures with hospitals to establish new campuses and/or finance those campuses. Further information on our risk factors is contained in our filings with the SEC, including the 10-K dated July 14, 2018. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Regulation G - Non-GAAP Financial Measures This presentation includes a discussion of Adjusted EBITDA and Adjusted Gross Margins, non-GAAP financial measures. Certain information regarding these non-GAAP financial measures (including reconciliations to GAAP) is provided on the Investor Relations section of the Aspen website at www.ir.aspen.edu. Safe Harbor Statement

3 Aspen Group Vision “To Make College Affordable Again”

4 Aspen Group’s Business Model Offer world class online education at half the cost of our competitors; committed to cash-based, monthly payment plans (no interest) “Let’s Change Higher Education Forever” Online Students can pay $325/month for a Master’s degree = $11,700 (36 months) Online Students can pay $250/month for a Bachelor’s Degree = $18,000 (72 months) Online Students can pay $375/month for a Doctoral Degree = $27,000 (72 months)

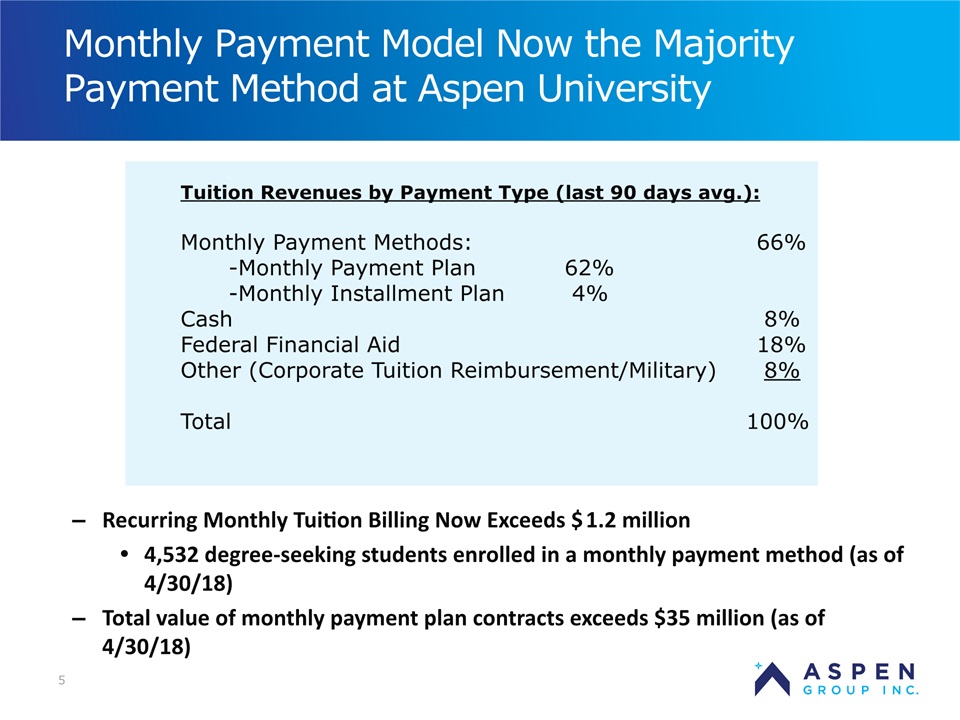

5 Monthly Payment Model Now the Majority Payment Method at Aspen University Recurring Monthly Tuition Billing Now Exceeds $1.2 million4,532 degree-seeking students enrolled in a monthly payment method (as of 4/30/18)Total value of monthly payment plan contracts exceeds $35 million (as of 4/30/18) Tuition Revenues by Payment Type (last 90 days avg.): Monthly Payment Methods: 66% -Monthly Payment Plan 62% -Monthly Installment Plan 4%Cash 8%Federal Financial Aid 18%Other (Corporate Tuition Reimbursement/Military) 8%Total 100%

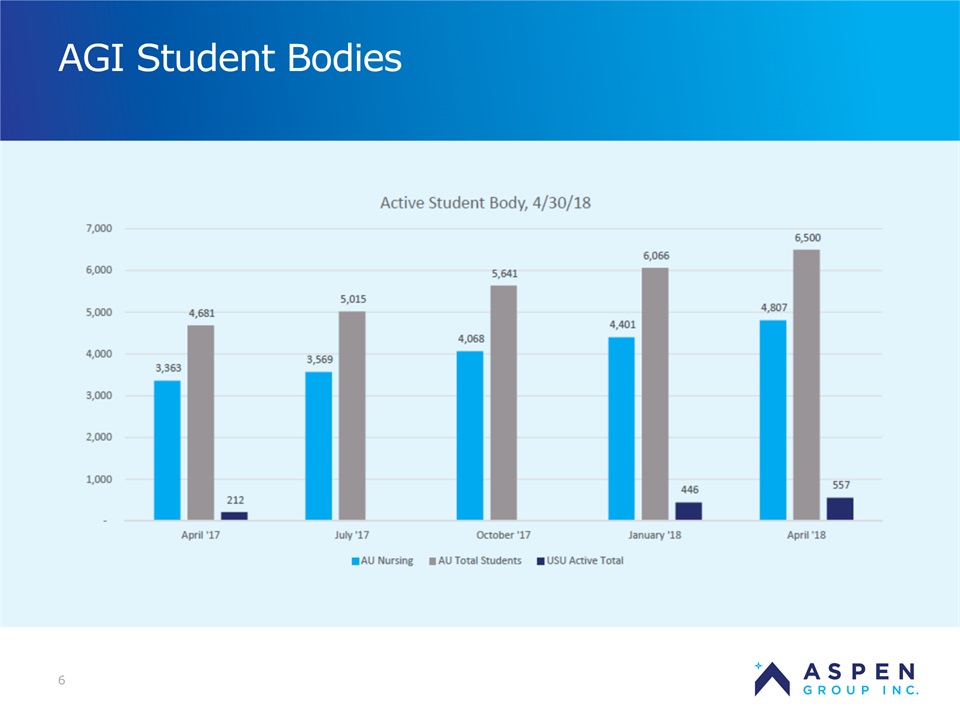

AGI Student Bodies 6

AGI Student Bodies 6

7 Targeting Four Growth Vectors

8 Growth Vector 1: RNs - Fully OnlineRN to BSN & MSN RNs (post-licensure):BSN & MSN2.9mm RNs in U.S. Today65,000 Starts per Annum(TAM: - $260mm)**Assumes $4,000 revenue in year 1

9 Aspen University Capturing ~2%Of BSN Completion Starts Approximately 140K RNs currently enrolled in BSN Completion programs; or approx. 50,000 new enrolls/year

10 Aspen University (Nursing + Other) Unit Economics Among Best In Sector Low customer acquisition costs and variable teaching costs create highly attractive unit economics – projecting 68%+ Gross Margins at scaleAverage course completions per student enrollment is 8 = $7,350* revenue (average $820 tuition/ course today and rising), earned over 4+ yearsDirect Cost ~$2,300Student acquisition cost ~ $1,124Teaching cost ~ $1,175 (average)Hybrid faculty model (Full-Time/Adjunct Faculty)<$150 per student course completionSave ~$50,000 annual per F-T conversionGross Profit/New Student Enrollment ~ $5,050 *Assumes $600 of misc. revenue/student

11 Growth Vector 2: Pre-Licensure BSN Hybrid Online/Campus Program Pre-Licensure BSN Program:(Hybrid Online/Campus Program)100,000 Pre-Licensure BSN Startsper Annum(TAM: - $1.5B)**Assumes $15,000 revenue in year 1

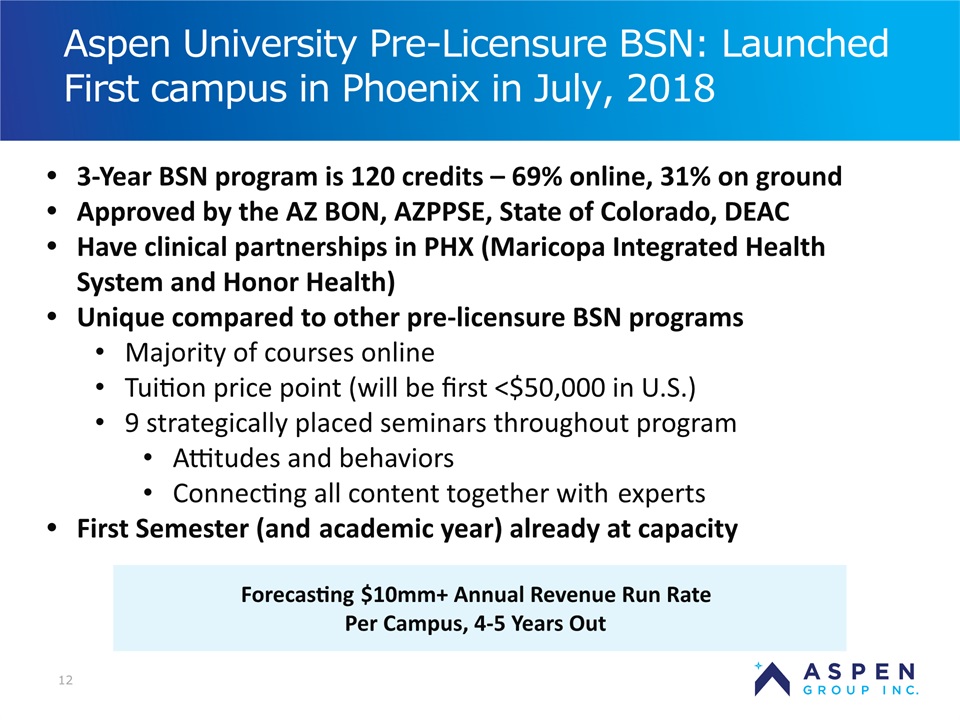

12 Aspen University Pre-Licensure BSN: LaunchedFirst campus in Phoenix in July, 2018 3-Year BSN program is 120 credits – 69% online, 31% on groundApproved by the AZ BON, AZPPSE, State of Colorado, DEACHave clinical partnerships in PHX (Maricopa Integrated Health System and Honor Health)Unique compared to other pre-licensure BSN programsMajority of courses onlineTuition price point (will be first <$50,000 in U.S.)9 strategically placed seminars throughout programAttitudes and behaviorsConnecting all content together with expertsFirst Semester (and academic year) already at capacity Forecasting $10mm+ Annual Revenue Run Rate Per Campus, 4-5 Years Out

13 Growth Vector 3: Doctoral Students – Fully Online Doctoral Programs (Fully Online):55,000 Graduates per Annum14% Online Students or ~8K/yr.(TAM: - $48mm)**Assumes $6,000 revenue in year 1

14 Growth Vector 4: RNs – MSN/FNP Hybrid Online Program USU to become the university of choice for preparing six-figure Nurse Practitioners ($27K: $375 for 72 months) RNs (post-licensure):MSN-Family Nurse Practitioner (Hybrid Online Program)234,000 NPs in U.S. Today (8% oftotal RNs)30,000 Starts per Annum (online/hybrid and campus-based programs) (TAM: - $300mm)**Assumes $10,000 revenue in year 1

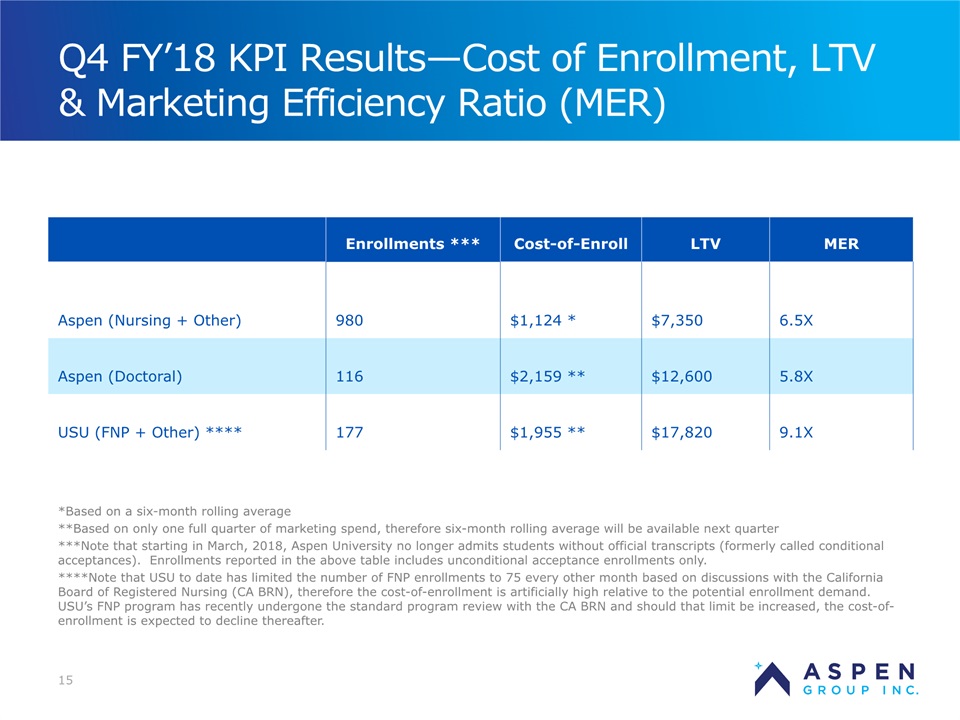

Q4 FY’18 KPI Results—Cost of Enrollment, LTV & Marketing Efficiency Ratio (MER) 15 *Based on a six-month rolling average**Based on only one full quarter of marketing spend, therefore six-month rolling average will be available next quarter***Note that starting in March, 2018, Aspen University no longer admits students without official transcripts (formerly called conditional acceptances). Enrollments reported in the above table includes unconditional acceptance enrollments only. ****Note that USU to date has limited the number of FNP enrollments to 75 every other month based on discussions with the California Board of Registered Nursing (CA BRN), therefore the cost-of-enrollment is artificially high relative to the potential enrollment demand. USU’s FNP program has recently undergone the standard program review with the CA BRN and should that limit be increased, the cost-of-enrollment is expected to decline thereafter. Enrollments *** Cost-of-Enroll LTV MER Aspen (Nursing + Other) 980 $1,124 * $7,350 6.5X Aspen (Doctoral) 116 $2,159 ** $12,600 5.8X USU (FNP + Other) **** 177 $1,955 ** $17,820 9.1X

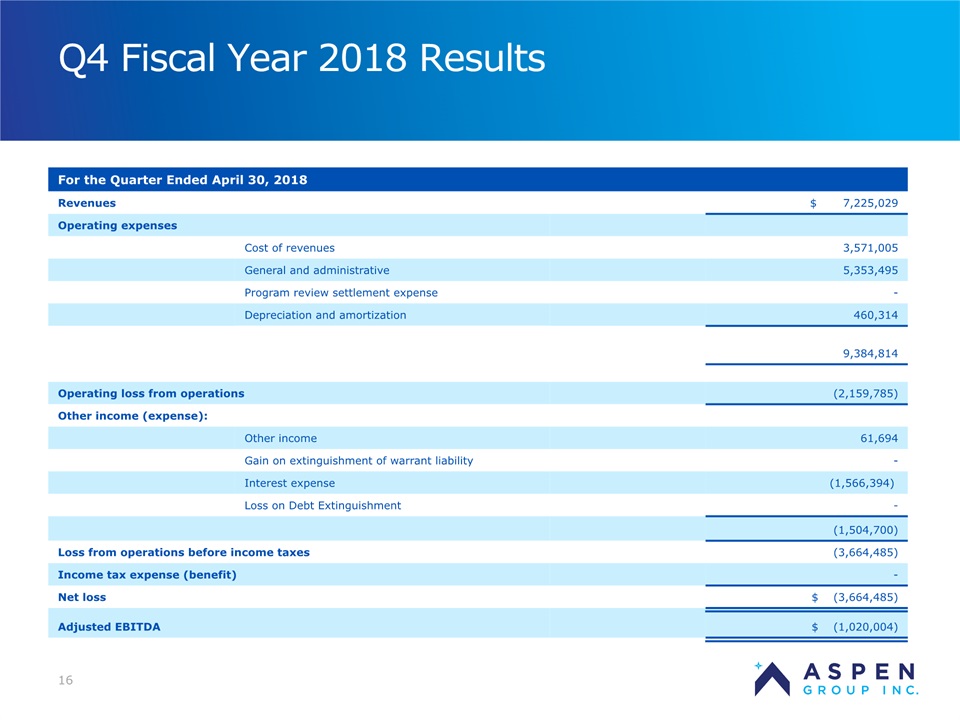

Q4 Fiscal Year 2018 Results 16 For the Quarter Ended April 30, 2018 Revenues $ 7,225,029 Operating expenses Cost of revenues 3,571,005 General and administrative 5,353,495 Program review settlement expense - Depreciation and amortization 460,314 9,384,814 Operating loss from operations (2,159,785) Other income (expense): Other income 61,694 Gain on extinguishment of warrant liability - Interest expense (1,566,394) Loss on Debt Extinguishment - (1,504,700) Loss from operations before income taxes (3,664,485) Income tax expense (benefit) - Net loss $ (3,664,485) Adjusted EBITDA $ (1,020,004)

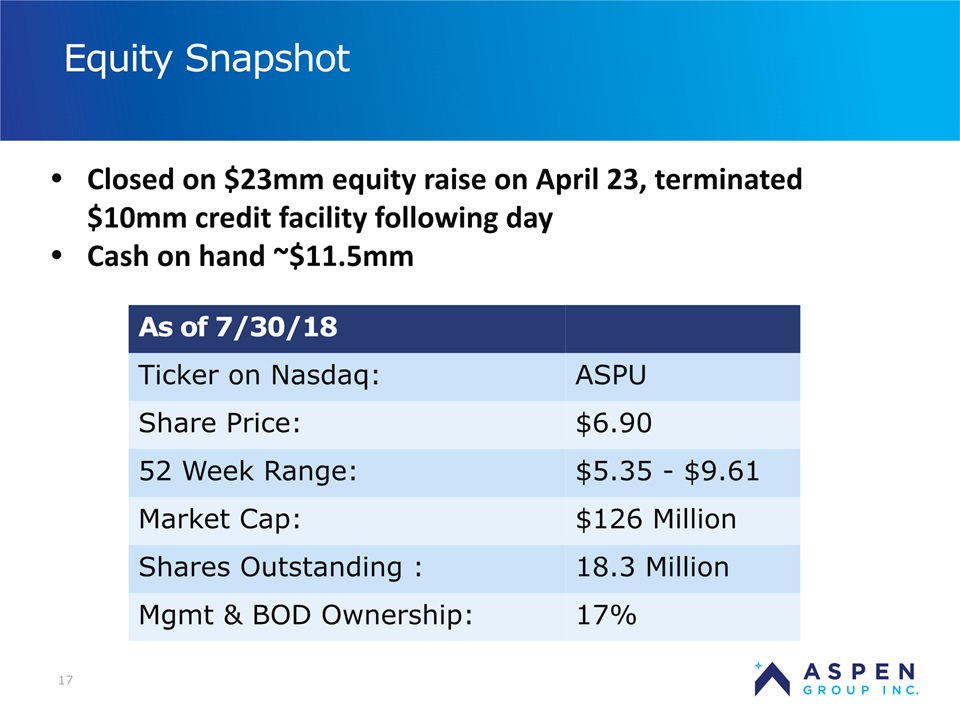

17 Equity Snapshot Closed on $23mm equity raise on April 23, terminated $10mm credit facility following day Cash on hand ~$11.5mm As of 7/30/18 Ticker on Nasdaq: ASPU Share Price: $6.90 52 Week Range: $5.35 - $9.61 Market Cap: $126 Million Shares Outstanding : 18.3 Million Mgmt & BOD Ownership: 17%

Q4 FY’18 Results 18

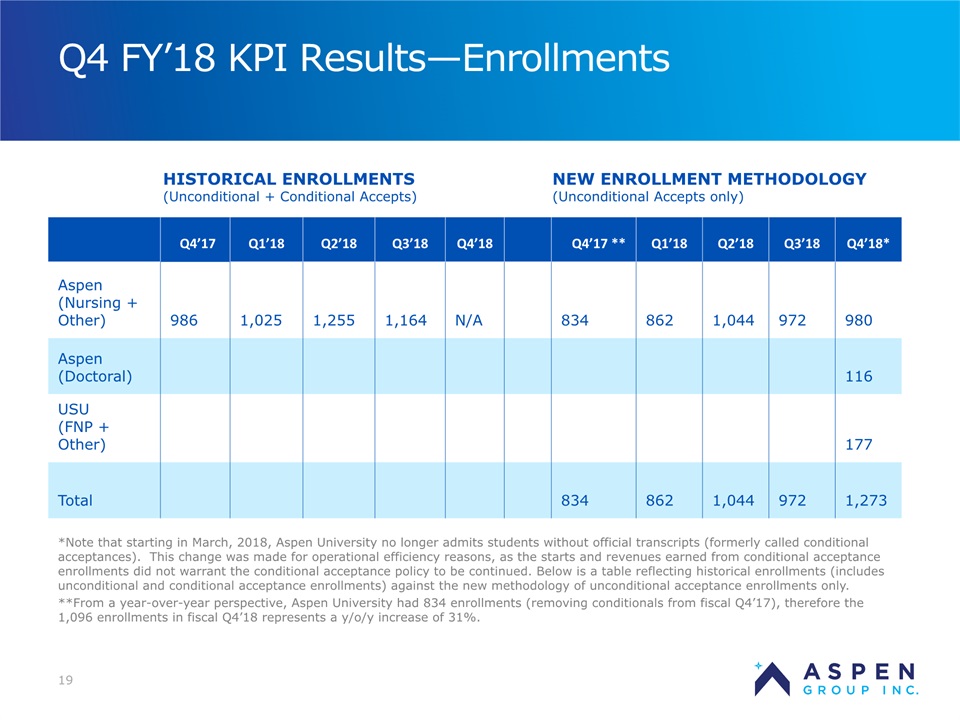

Q4 FY’18 KPI Results—Enrollments 19 *Note that starting in March, 2018, Aspen University no longer admits students without official transcripts (formerly called conditional acceptances). This change was made for operational efficiency reasons, as the starts and revenues earned from conditional acceptance enrollments did not warrant the conditional acceptance policy to be continued. Below is a table reflecting historical enrollments (includes unconditional and conditional acceptance enrollments) against the new methodology of unconditional acceptance enrollments only. **From a year-over-year perspective, Aspen University had 834 enrollments (removing conditionals from fiscal Q4’17), therefore the 1,096 enrollments in fiscal Q4’18 represents a y/o/y increase of 31%. Q4’17 Q1’18 Q2’18 Q3’18 Q4’18 Q4’17 ** Q1’18 Q2’18 Q3’18 Q4’18* Aspen (Nursing + Other) 986 1,025 1,255 1,164 N/A 834 862 1,044 972 980 Aspen (Doctoral) 116 USU (FNP + Other) 177 Total 834 862 1,044 972 1,273 HISTORICAL ENROLLMENTS (Unconditional + Conditional Accepts) NEW ENROLLMENT METHODOLOGY (Unconditional Accepts only)

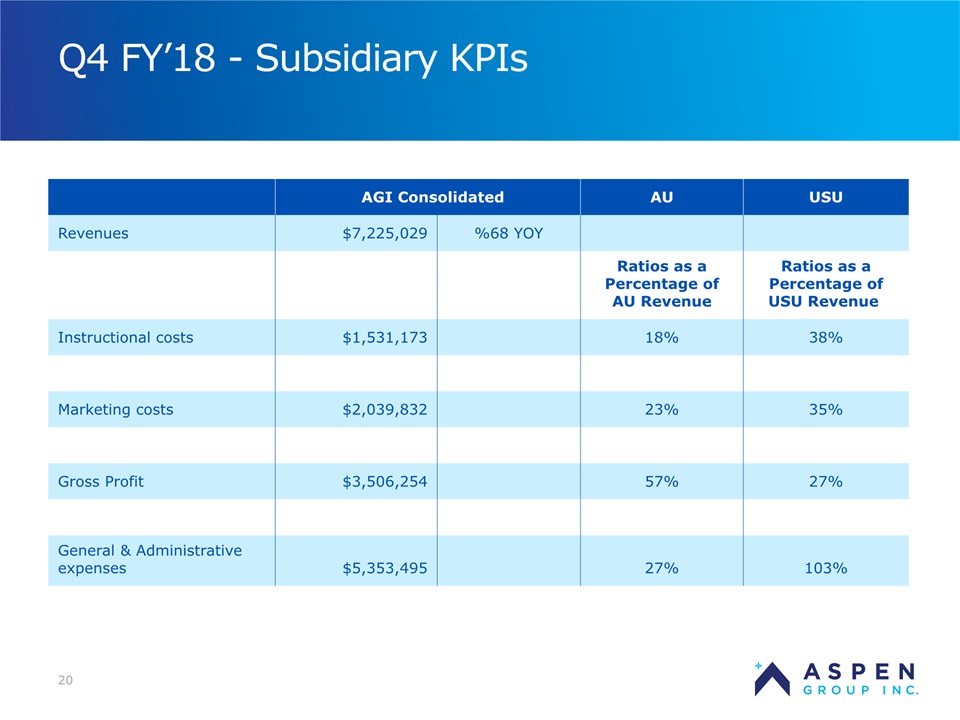

Q4 FY’18 - Subsidiary KPIs 20 AGI Consolidated AU USU Revenues $7,225,029 68% YOY Ratios as a Percentage of AU Revenue Ratios as a Percentage of USU Revenue Instructional costs $1,531,173 18% 38% Marketing costs $2,039,832 23% 35% Gross Profit $3,506,254 57% 27% General & Administrative expenses $5,353,495 27% 103%

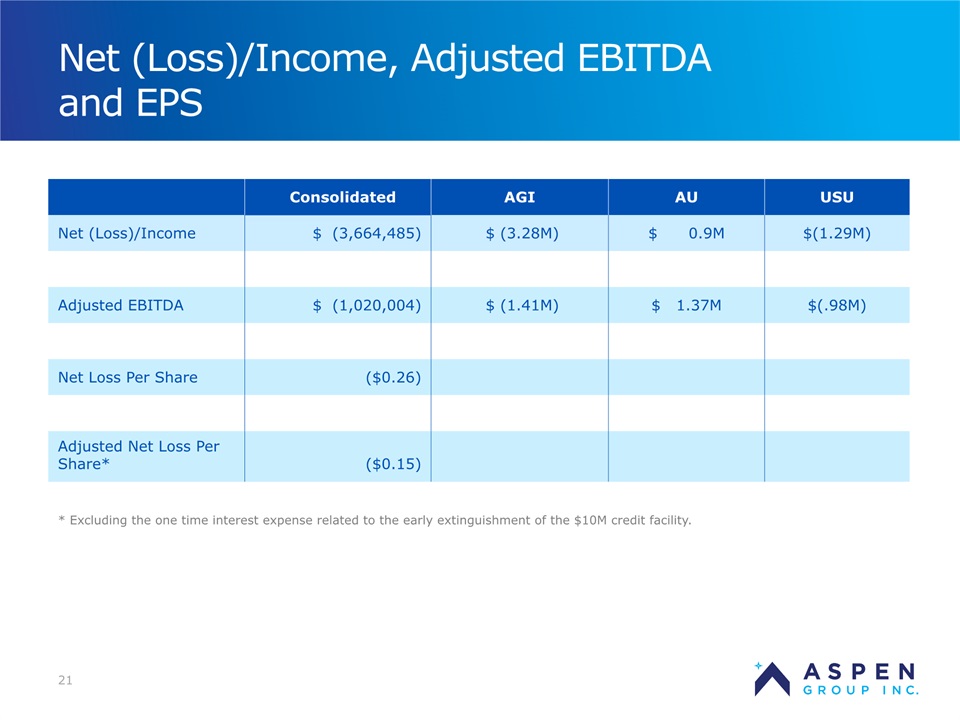

Net (Loss)/Income, Adjusted EBITDA and EPS 21 Consolidated AGI AU USU Net (Loss)/Income $ (3,664,485) $ (3.28M) $ 0.9M $(1.29M) Adjusted EBITDA $ (1,020,004) $ (1.41M) $ 1.37M $(.98M) Net Loss Per Share ($0.26) Adjusted Net Loss Per Share* ($0.15) * Excluding the one time interest expense related to the early extinguishment of the $10M credit facility.