Exhibit 99.2

Investor Presentation B. Riley Institutional Investor Conference May 2022

CONFIDENTIAL 1 Organizational Overview Offering a full suite of nursing degree programs through two accredited universities Primary Degree Programs 10,200 Students Bachelor of Science in Nursing (Pre - Licensure) 68% of FY2022 Revenue Primary Degree Programs 3,100 Students 32% of FY2022 Revenue RN Post - Licensure Degrees Master of Science in Nursing (5 Specializations) Doctor of Nursing Practice RN to BSN Master of Science in Nursing – Family Nurse Practitioner (MSN - FNP)

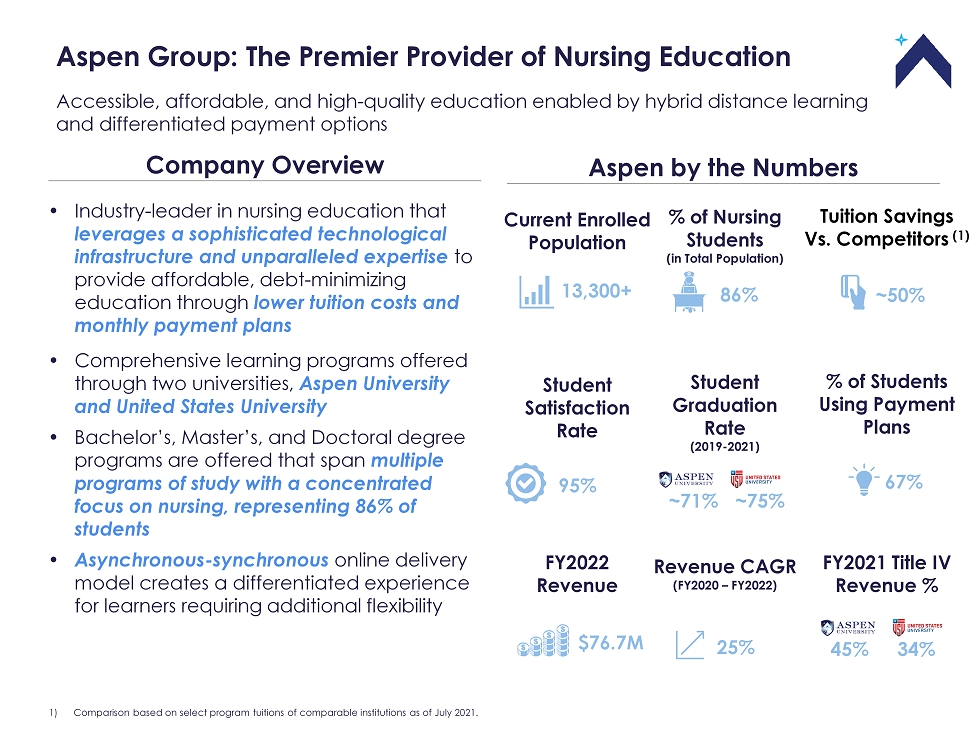

CONFIDENTIAL 2 Aspen Group: The Premier Provider of Nursing Education Accessible, affordable, and high - quality education enabled by hybrid distance learning and differentiated payment options Industry - leader in nursing education that leverages a sophisticated technological infrastructure and unparalleled expertise to provide affordable, debt - minimizing education through lower tuition costs and monthly payment plans Comprehensive learning programs offered through two universities, Aspen University and United States University Bachelor’s, Master’s, and Doctoral degree programs are offered that span multiple programs of study with a concentrated focus on nursing, representing 86% of students Asynchronous - synchronous online delivery model creates a differentiated experience for learners requiring additional flexibility Company Overview Aspen by the Numbers 1) Comparison based on select program tuitions of comparable institutions as of July 2021. Current Enrolled Population FY2022 Revenue $76.7M Student Satisfaction Rate 95% 13,300+ Revenue CAGR (FY2020 – FY2022) 25% % of Nursing Students (in Total Population) 86% Student Graduation Rate (2019 - 2021) ~71% ~75% FY2021 Title IV Revenue % % of Students Using Payment Plans 67% 45% 34% Tuition Savings Vs. Competitors (1) ~50%

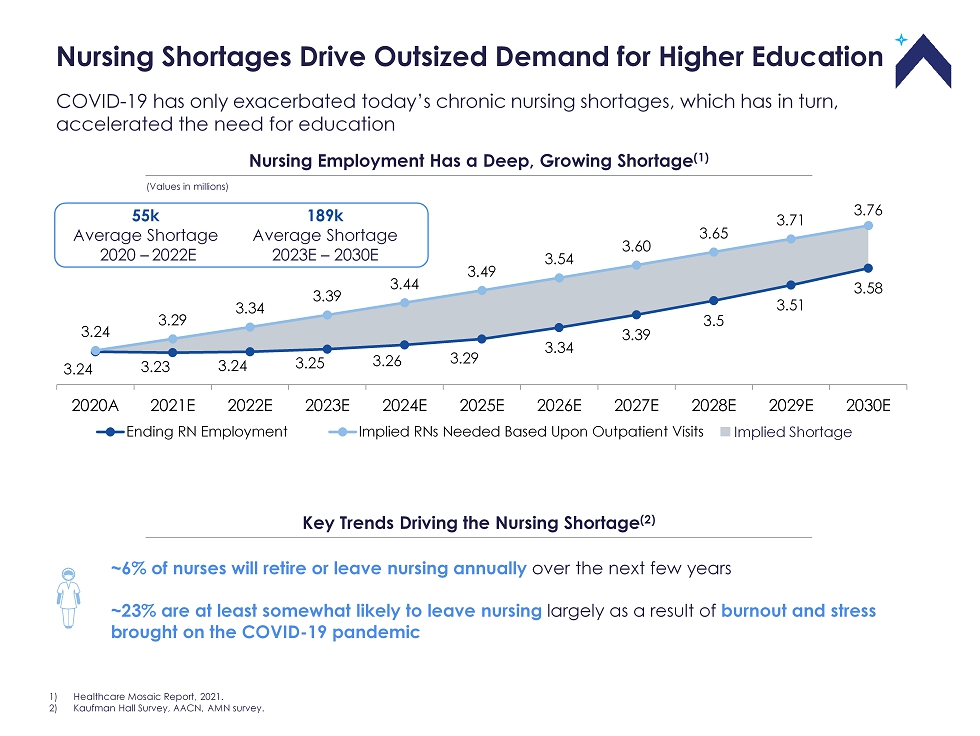

CONFIDENTIAL 3 3.24 3.23 3.24 3.25 3.26 3.29 3.34 3.39 3.5 3.51 3.58 3.24 3.29 3.34 3.39 3.44 3.49 3.54 3.60 3.65 3.71 3.76 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E 2029E 2030E Ending RN Employment Implied RNs Needed Based Upon Outpatient Visits COVID - 19 has only exacerbated today’s chronic nursing shortages, which has in turn, accelerated the need for education Nursing Shortages Drive Outsized Demand for Higher Education 55k Average Shortage 2020 – 2022E 189k Average Shortage 2023E – 2030E Implied Shortage ~6% of nurses will retire or leave nursing annually over the next few years ~23% are at least somewhat likely to leave nursing largely as a result of burnout and stress brought on the COVID - 19 pandemic Nursing Employment Has a Deep, Growing Shortage (1) (Values in millions) Key Trends Driving the Nursing Shortage (2) 1) Healthcare Mosaic Report, 2021. 2) Kaufman Hall Survey, AACN, AMN survey.

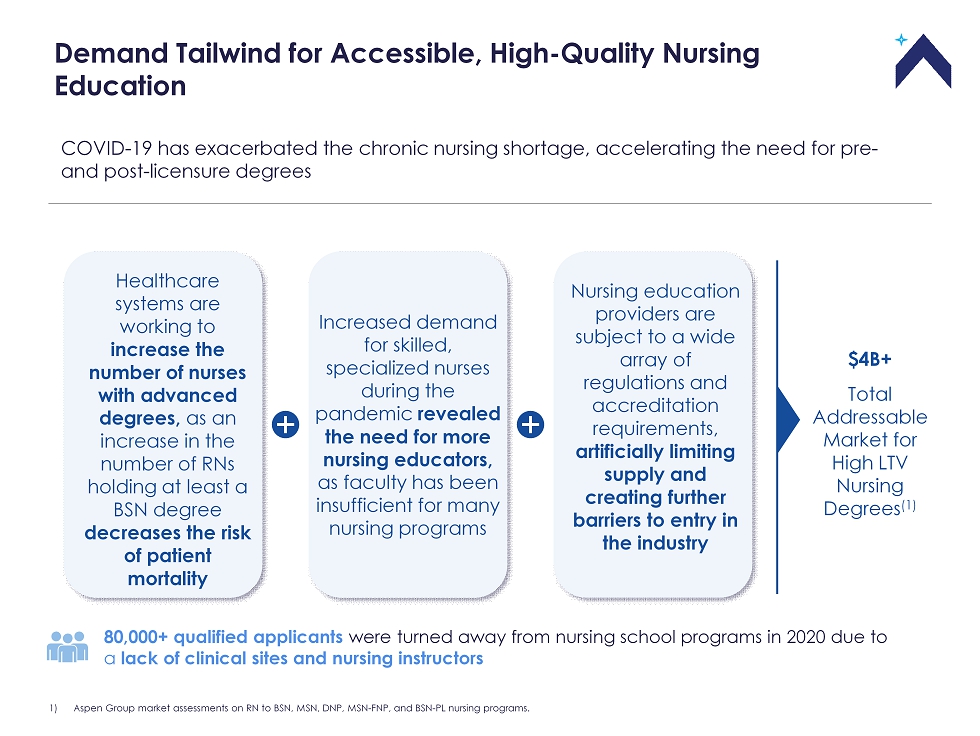

CONFIDENTIAL 4 COVID - 19 has exacerbated the chronic nursing shortage, accelerating the need for pre - and post - licensure degrees Demand Tailwind for Accessible, High - Quality Nursing Education 1) Aspen Group market assessments on RN to BSN, MSN, DNP, MSN - FNP, and BSN - PL nursing programs. Increased demand for skilled, specialized nurses during the pandemic revealed the need for more nursing educators, as faculty has been insufficient for many nursing programs Nursing education providers are subject to a wide array of regulations and accreditation requirements, artificially limiting supply and creating further barriers to entry in the industry Healthcare systems are working to increase the number of nurses with advanced degrees, as an increase in the number of RNs holding at least a BSN degree decreases the risk of patient mortality $4B+ Total Addressable Market for High LTV Nursing Degrees (1) 80,000+ qualified applicants were turned away from nursing school programs in 2020 due to a lack of clinical sites and nursing instructors

CONFIDENTIAL 5 Our Growth Levers… Long - Term Strategic Growth Levers and Objectives Ongoing Marketing Spend Periodic New Campuses Optional New Degrees Increasing or decreasing marketing spend has a direct and immediate impact on student enrollment Opening new campuses drives growth of our high - LTV Pre - Licensure program, the market segment with the highest TAM The option to add new degrees in nursing or other licensure programs expands our addressable market …Drive Our Long - term Strategic Growth Objectives Grow Enrollment in Existing Programs Expand Campus Footprint Increase Degree Programs Drive enrollment in high - LTV programs with strategic marketing spend and support expansion into new markets or programs Open new campuses in large metros in new states and new metros in states where we are already operating Pre - licensure campuses Add new nursing degree programs to round out our offering and potentially leverage our experience in licensure degree programs into new market segments